Dear Dave,

How do you feel about people taking money out of savings to pay off credit cards? I have an emergency fund in place, like you recommend, and a savings account. I also have about $5,000 in credit card debt. What’s your take on this?

Kellye

Dear Kellye,

Honestly, I’d rather see you pick up a side job nights or weekends. That’s not a ton of debt, and you could have it paid off in just two or three months with a decent part-time job. Plus, it’d keep your savings intact.

But if you’re determined to do it your way, I’ll give you a couple of guidelines. Number one, don’t wipe out your savings to make this happen. The second? Cut up the credit cards, close the accounts and never go into debt again.

Now, whatever you do, here’s something I want you to understand. And I need you to really hear me when I say this, ok? The credit cards aren’t the problem. The debt you’ve racked up on the credit cards isn’t really the problem, either. Both of those are just symptoms of buying things you don’t need, with money you don’t have, in order to make yourself feel better momentarily, or impress other people.

Kellye, you won’t find the real problem until you take a good, long, honest look in the mirror. It’s you. You’re the problem. Whether it’s because of overspending, a lack of income or just simply being disorganized, you (and your behavior with money) are the problem.

I’m not trying to be mean, but do you get what I’m saying? Being successful with your finances is 80% behavior, and only 20% knowledge. Your everyday habits and mindset go a long, long way in determining whether you’ll live from paycheck-to-paycheck—and in debt—or gain control of your money and become a financial success.

Being broke and weighed down by debt is normal in today’s culture. If you’re not already doing this, and it sounds like you’re not, I want you to start living on a written, monthly budget. I’ve got a feeling you don’t know where your money’s going right now. Doing this, and giving every dollar of your income a job to do before the month begins, is the best way I know of to get control of your money.

Because if you don’t, a lack of money and planning will control you!

— Dave

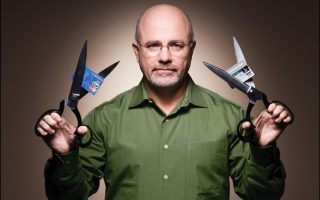

Dave Ramsey is an eight-time national bestselling author, personal finance expert, and host of “The Ramsey Show.” He has appeared on “Good Morning America,” “CBS This Morning,” “Today,” Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth, and enhance their lives. He also serves as CEO of Ramsey Solutions and is the author of numerous books including Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth–and How You Can Too.

Comments