You’ve probably used Cash App to send money to friends or make contactless payments. However, the app can do much more than that. Cash App allows you to open a bank account through the platform, buy and sell bitcoin, and even invest in stocks. If you’re ready to get started with trading, you may be wondering, what is the best stock to invest in on Cash App?

Here are five stocks you can purchase on Cash App that may be worth looking into.

What Is the Best Stock to Invest in on Cash App?

Cash App allows you to invest in top companies such as Shopify and Apple. You only need a balance of $1 to start investing and purchasing stocks. Cash App doesn’t have any monthly maintenance fees, trade commissions, or minimum balance requirements. This makes it a great platform for beginners who are new to investing.

There are over 1,800 stocks and ETFs you can invest in through the platform. Check out five of the best stocks to invest in on Cash App below.

Shopify

This year, e-commerce sales are expected to increase by 8.8% If you want to get in on that growth, consider investing in Shopify. It’s a top e-commerce platform that helps businesses build and run their online stores. Shopify’s e-commerce solutions are used by retailers in over 175 countries.

Shopify has significant market share in the e-commerce space, especially in the US. As of last year, around 30% of all e-commerce websites in the US were built with Shopify. The company is also expanding its reach in other countries. In the third quarter of 2023, the number of Shopify stores in the UK increased by 41% year-over-year.

Additionally, Shopify had a record Black Friday with over $9 billion in sales, which helped poise it for a strong start to 2024. The company has reportedly been working to improve its profitability and margins even further, which helps make it a major contender for the best stock to invest in on Cash App.

Apple

Apple was a stock to watch in 2023 and continues to be a top choice for investors in 2024. The company’s stock has a pretty reliable, consistent record, making it an option worth considering. From 2019 to 2023, Apple’s stock rose 306% according to The Motley Fool.

As of March 2024, experts say Apple stock is likely a better value than shares from competitors like Microsoft and Amazon. Apple reportedly has more free cash flow than some of the top names in tech, which puts it in a strong position. The company grew its available cash by 10% in 2023, allowing it to make strategic business investments that may help drive growth.

Its strong name recognition and broad range of products also help position the company for success. The recent launch of the Vision Pro has the potential to bolster sales for years to come, especially considering the growth potential of the virtual reality market. Apple is even hoping to break into the self-driving vehicle market by 2026, which could allow the company to grow and expand even further.

NVIDIA Inc.

NVIDIA Inc. is poised to benefit from the recent popularity of artificial intelligence. The semiconductor company produces custom-made AI chips that power tools like ChatGPT. According to Benzinga, the company’s share price tripled in 2023, and its valuation is over $1 trillion.

Although NVIDIA stock has some downsides, it still seems like a good pick. The company may face competition from other chip producers like Advanced Micro Devices. The stock price is also high, but experts believe NVDA hasn’t reached its peak yet. The company is having amazing earnings growth, and profits are projected to continue growing by around 100% in the second quarter. So even though NVDA isn’t a low-cost option, it might be worth adding to your portfolio.

Amazon

The best time to buy Amazon stock in recent history was probably a year or two ago. But perhaps the second best time is now. Investing pundits say they expect the price of Amazon stock to keep rising even though it’s pretty high. The stock could continue to climb back to the record peak it reached in 2021, potentially making a full recovery from its 2022 downswing.

According to Investors.com, about 95% of Amazon stock analysts have given AMZN a “buy” rating despite the high price tag. The company’s strategic partnerships with NVIDIA and Anthropic, the makers of AI chatbot Claude, are helping to solidify its position as a leader in the artificial intelligence space. Amazon is also beefing up its pharmacy operation, which may help drive growth.

Walt Disney

Experts say Disney is making a lot of strategic moves right now that could lead to growth. The company scored exclusive streaming rights for Taylor Swift’s Eras Tour film. It also has several movies that could be hits in the works, including a Lion King follow-up and a live-action version of Moana.

Additionally, the company is working on a collaboration with the makers of the popular game Fortnite and implementing cost-cutting measures to help boost profits. Disney’s first-quarter earnings report was promising, showing around 50% growth compared to the same period a year ago. Overall, it seems like it could be a good time to hop on the Disney bandwagon.

Honorable Mentions

Synopsys

Similar to NVIDIA, reports suggest that Synopsys could be another rising star in the AI industry. The company’s electronic design automation solutions could play a key role in artificial intelligence development. Its recent earnings report was strong and showed 21% year-over-year revenue growth. Its stock has also increased 80% since last year. Synopsys is also trying to acquire Ansys, a design simulation software provider. If the merger is successful, it could help Synopsys further expand its reach and influence.

Adobe Inc.

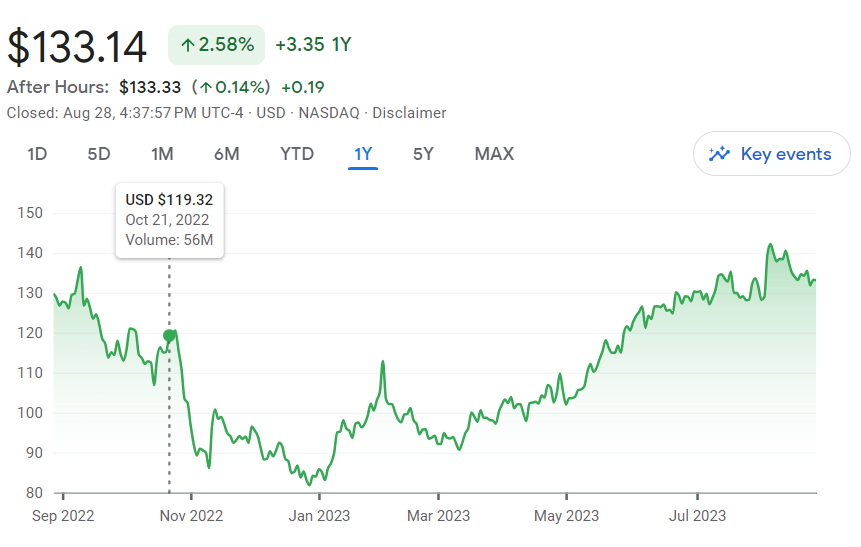

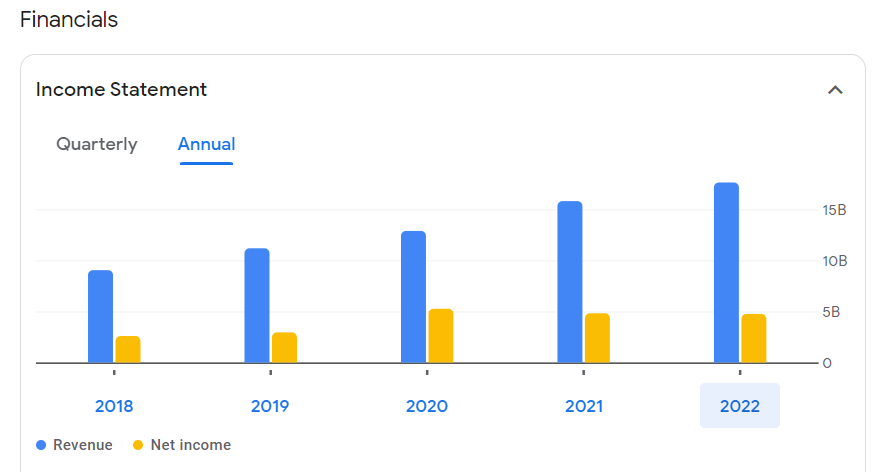

Adobe’s recent performance has disappointed investors due to slowing sales growth. However, some still believe that the company is a good long-term investment. Adobe is a software company that has produced top design programs such as Photoshop and Illustrator. The brand is expanding into the AI space with its image generation tool Firefly, which has reportedly been well-received.

As you can see in the chart above, Adobe has shown a consistent pattern of increasing revenue and net income. Since Adobe is investing in growth areas like AI tech, the company might be worth a second look despite recent underperformance.

Picking Individual Stocks Isn’t Easy, So Manage The Risk

Making money by picking stocks is notoriously difficult. However, there are some effective ways to manage your risk. Here are three; use a stock-picking service; borrow ideas from professional investors or go with an established stock-picking methodology. Here are a few words about each option.

Use A Stock Picking Service

The Motley Fool Stock Advisor

There are several good stock-picking services available. A good one is The Motley Fool’s Stock Advisor. The Motley Fool’s stock advisor is the flagship stock-picking newsletter of the Motley Fool organization. They’ve historically made some good calls – including identifying Amazon when it started its early growth phase. Their service charges about $79 per year. You can buy it here.

If you’re going to get the Motley Fool Stock Advisor, don’t pay full price. Instead, hack the price. The hack is: buy the Motley Fool through Dollar Dig. Dollar Dig is a cash-back site, which will give you $50 back. The way to do that is to just open an account at Dollar Dig and buy The Motley Fool through Dollar Dig – it’s easy and you’ll only pay $29 for The Motley Fool Stock Advisor. Open an account at Dollar Dig here.

Seeking Alpha

Seeking Alpha is a well-regarded, crowd-sourced content service that publishes news on financial markets. Independent contributors write most of the articles, usually for investors interested in purchasing stocks and other securities. Notable contributors include Henry Blodget as well as others.

Seeking Alpha is enormously popular and is a well-regarded platform – it received favorable mentions in 2007, 2011, and 2013 (here).

You can currently get their premium subscription for $199. This subscription is normally $239. You can check them out here.

Borrow Ideas From Professional Investors

A lot of new investors get their ideas from social media. This can tell you which stocks are popular, not which ones have underlying good businesses that will result in long-term price gains.

A good way to find stocks is to check the holdings of mutual funds or exchange-traded funds (ETF) and see which companies they are buying. Since mutual funds and ETFs are typically run by professional money managers, they should, in theory, make better stock selection choices than the average retail investor. This is essentially what people do when they copy Warren Buffet and Charlie Munger’s Berkshire Hathaway investing strategy.

A good place to start might be the Dodge and Cox stock market fund’s holdings, here.

Use An Established Stock Picking Methodology

Value Stocks

Some stock-picking methods appear to work well. One of these is value investing. Value investing is an investing strategy based on identifying good quality companies with low stock prices. This perspective has historically generated excess returns (here). While accounting changes and macroeconomic regulatory changes have made the value investing perspective less useful today, identifying value stocks is straightforward.

You simply fire up a stock screener and filter for company metrics such as the Price to Earnings Ratio (PE Ratio), Price to Book ratio, or Debt-to-equity ratio.

CANSLIM

Another established stock-picking approach is CANSLIM. This is a method of selecting stocks based on fundamental and growth metrics.

The CANSLIM metrics are:

C = Current Quarterly Earnings, earnings growth of at least 25%.

A = Annual Earnings Growth, growth of at least 25% over the past 3 years

N = New Product or Service. Most stock market greats have new innovative products.

S = Supply and Demand. Institutional investors buying a lot of the company is a plus.

L = Leader Or Laggard. Look for industry leaders showing strong sales growth.

I = Institutional Sponsorship. Big institutional investors signal price increases.

M = Market Direction. Three out of 4 stocks follow market trends, so select stocks that are in sync with the market.

CANSLIM was developed in the 1950s by William O’Neil. CAN SLIM is a growth stock investing strategy formulated from a study of stock market winners dating back to 1953 in the book How to Make Money in Stocks: A Winning System In Good Times or Bad. The strategy is a hybrid of both technical analysis and fundamental analysis.

CANSLIM was developed in the 1950s by William O’Neil. CAN SLIM is a growth stock investing strategy formulated from a study of stock market winners dating back to 1953 in the book How to Make Money in Stocks: A Winning System In Good Times or Bad. The strategy is a hybrid of both technical analysis and fundamental analysis.

How to Make Money In Stocks sells for under $5 on Amazon. If you’re serious about finding the best stock to invest in on cash app, getting this book is a no-brainer. Five dollars is less than the price of a fancy cup of coffee and the knowledge could easily be worth thousands to you. You can get it on Amazon, here.

Which stocks do you plan to invest in on Cash App this year? Let us know in the comments!

Read More

Here Are Three Seasonal Stocks That Should Be In Your Portfolio

Which AI Stocks Make Sense to Buy Now?

Come back to what you love! Dollardig.com is the most reliable cash-back site on the web. Just sign up, click, shop, and get full cashback!

Vicky Monroe is a freelance personal finance and lifestyle writer. When she’s not busy writing about her favorite money saving hacks or tinkering with her budget spreadsheets, she likes to travel, garden, and cook healthy vegetarian meals.

Comments