Dear Dave,

Should I cash in my 401(k) to pay off my car? I have just enough in the account to pay off the car and free up money in my budget.

Marina

Dear Marina,

If I were in your shoes, and I could pay off the car in 18 months or less, I’d live on rice and beans—plus a very strict monthly budget—and just push through until that car payment was out of my life. If that wasn’t realistic, then I’d take out ads online and in the local paper, and sell the car as fast as possible.

Cashing out your retirement plan to make this happen isn’t a good idea. I love that you want to get rid of your car payment, but if you use your 401(k) they’ll charge you a 10% penalty, plus your tax rate. That means you’ll lose anywhere from 30 to 50 percent of it to the government.

I don’t know about you, Marina, but I think those guys get way too much of our money already!

— Dave

Dear Dave,

My husband was recently told layoffs are about to happen at his company, and that it might be a good idea for him to start looking for another job. He has found a couple of good possibilities, but the jobs are located 100 miles away. In preparation for a possible move, we spoke with a real estate agent who told us we’d have to remodel our kitchen to sell the house. We’ve got about $4,000 in savings, but the agent said remodeling would take between $2,500 and $3,000. Should we get a second mortgage to pay for the work?

Natalie

Dear Natalie,

For starters, I’d suggest cutting expenses any way you can, living on a strict budget and saving as much cash as possible. But taking out a second mortgage? No! You don’t want that hanging over your heads.

You might want to get another opinion on the kitchen remodel, too. Sure, a new kitchen would be nice, but would it be a make-or-break kind of thing if you decide to sell your home? Probably not, unless it’s in really terrible shape right now. Regardless, there’s no way I’d go into debt to make this happen. I mean, your house isn’t even on the market yet. There’s no reason to fix up a house that’s not for sale, especially when you’ve got just $4,000 to your names.

My advice is to wait and see how the whole job situation plays out before making any big decisions. Then if you end up selling the house and moving, you might take $500 or so from savings to freshen up the kitchen a little bit.

— Dave

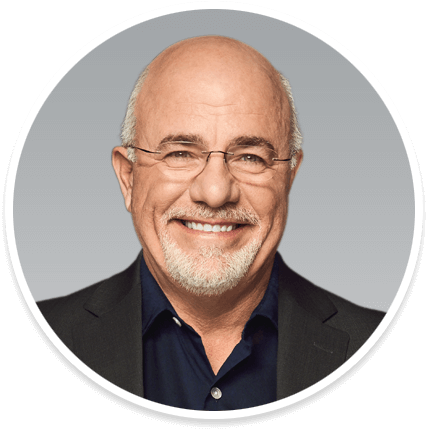

Dave Ramsey is an eight-time national bestselling author, personal finance expert, and host of “The Ramsey Show.” He has appeared on “Good Morning America,” “CBS This Morning,” “Today,” Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth, and enhance their lives. He also serves as CEO of Ramsey Solutions and is the author of numerous books including Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth–and How You Can Too.

Comments