Simple Inflation Investment

So you are listening to the talking heads sing the inflation blues and all the ways to beat it. Suddenly, the room begins to spin, then you faint or fall asleep. Either way, you lose consciousness.

You are just looking for something simple. Something safe. Something to give you an edge on inflation.

Usually, this is where someone slaps you and says, “life ain’t simple, Skippy.” However, that would be entirely inappropriate. Why? Because there is something simple, safe, and paying interest about a point above inflation — the I Bond.

What Is an I Bond?

Series I Savings Bonds are currently paying 7.12 percent. That rate is good through April when the interest adjusts for inflation. The rates are set twice a year and rise and fall with inflation.

I Bonds are issued by the U. S. Treasury, just like other government bonds. Therefore, they have the full backing of the federal government. That is the safety component.

The “I” stands for inflation. These bonds were specifically created as a safeguard against inflation. However, they offer fringe benefits.

I Bonds earn interest federal tax-deferred, and there is no state or local where you redeem them.

What’s The Catch?

The I Bond comes with a few restrictions.

Individuals can invest up to $10,000 a year, and married couples are limited to $20,000.

You also have to hold I bonds for 12 months before redeeming them. You can cash in after that. However, if you cash in before five years, you’ll lose interest earned in the three most recent months. After five years, there is no early withdrawal penalty.

Federal taxes are accessed on your gains when you cash the bonds.

How Do You Get Your I Bonds?

You can buy I Bonds directly from the Treasury. However, you can also purchase them at banks or through a broker. Note that brokers do not earn fees on I Bonds, so they might not be enthusiastic about them.

Conclusion

I Bonds can be an excellent investment to beat inflation, especially if you have money in low-interest taxable accounts such as CDs. However, the I Bond is not for you if you can not invest it for at least a year.

“Excess” Savings Evaporating

When are savings excess? And, if savings are excess, why is it a problem when they are reduced?

In financial jargon, excess savings describes the amount people saved above their average savings rate as a result of government stimulus payments.

Stimulus Impact

The first Covid stimulus checks began arriving in American bank accounts in mid-April of 2020. Since that time, over $478 million has been paid to U. S. citizens.

The government checks went into savings accounts, stocks and other investments, debts, and groceries. In other words, the wealth socked the money away, and poorer people used it to get by.

Poor Getting Poorer

The last stimulus checks went out last Spring. Now, poor and middle-class families are beginning to have trouble paying bills.

Over 30 percent of Americans are struggling to pay their daily expenses, according to data from the U. S. Census Bureau.

“Nearly 83 million adults — 34 percent of all adults in the country — reported that their household found it somewhat or very difficult to cover usual expenses such as food, rent or mortgage, car payments, medical expenses, or student loans in the last seven days,” according to the report.

It is even more challenging for children, according to the Center for Budget and Policy Priorities.

“Hardship rates are even higher for children: an estimated 45 percent of all children live in a household that reported it was somewhat or very difficult to cover usual expenses,” reports the center.

A recent study by J. P. Morgan Chase & Co. found that low-income families got the most significant boost from stimulus checks. However, those families also ran through that money faster than others. That is because they had little or no savings to begin with.

Middle-Class Close Behind

Middle-class working families are not far behind poorer families, according to a report from Moody’s Analytics. That report found that many middle-class households will exhaust their savings in a few months.

Child Tax Credit

Many families got extra support from the Child Tax Credit last year. The program expanded to $3,600 per child paid in monthly installments. It was also extended to families that were previously unable to qualify for the full benefit because their incomes were too low.

However, the Child Tax Credit payments ended in December because Democratic Senator Joe Manchin joined Republicans in opposing Biden’s Build Back Better Act. That legislation would have continued payments to 30 million families for another year.

Fourth Check

The Omicron variant has only added to the problem. The new Covid off-shoot has caused colleges to close, pushed back plans to return to offices, reduced air travel, and prohibited many parents from rejoining the workforce.

Even before that, twenty-one Senate Democrats signed a letter to President Joe Biden urging recurring stimulus checks.

Various groups have joined the call for continued support for families. For instance, Change.org has garnered over three million signatures supporting ongoing stimulus checks. Likewise, the Senior Citizen’s League has spearheaded a move to get additional checks for seniors.

Do The Hustle

The second decade of this millennium will wear various tags from “The Great Resignation” to “the Era of Covid.” It may also be known as the “side hustle shift.”

More people are looking for or launching side hustles today than at any time in recent history. Some are supplementing income, some are trying to pay off debt, replace income, or supplant an unrewarding job.

Numbers Growing

“One in three Americans—34 percent—have a side hustle,” according to a 2021 Zapier Survey. Many of these gigs launched recently.

“Among Americans who have a side hustle,” Zapier reports, “two-thirds (67 percent) started it within the past three years, and about 3 in 10 (31 percent) started in 2020.”

Millennials Lead

Millennials make up the largest group of side hustlers. Almost half of this age group has a side hustle. They are followed by Gen Xers at 39 percent and Baby Boomers at 28 percent, reports Smarts.

What’s Your Hustle?

You can make extra money with side hustles such as delivery services; at-home clothes cleaner; Airbnb hosting; search engine and social media rater; reseller and many more.

Here is a look at a few you may not have considered.

Virtual Assistant

These people help busy people with full-time jobs or their own businesses stay organized. That means doing things such as making appointments, following up on phone calls and emails. You might also make travel arrangements and keep their receipts in order.

Incomes for such a job average above $19 an hour, according to Indeed.

Pet Travel Nanny

This might be perfect if you like pets and travel.

Families and adoption services sometimes need a person to accompany an animal on a long trip to a new home. Transportation can be in your vehicle or on an airplane.

Over-the-road travel pays 50 to 75 cents a mile, according to FosterFurkids, a service that pairs people who drive with Dogs and Cats who do not drive.

NFT Graphic Designer

This is a growing field that may be the fastest track to your own business.

Demand for NFTs (Non-Fungible Tokens) is growing exponentially. Collectors are gobbling them up — sometimes in lots of thousands. They are also being used as currency or deeds in the Metaverse.

“There’s a lot of money to be made,” Elmer Morales, founder of Campus Metaverse told Yahoo! money. He says freelancers can make more than $40 an hour.

Social Media Manager

Small and medium-sized businesses need a clear and prominent social media presence now more than ever. However, most business owners do not have the time, knowledge, or patience to fill that need.

A random search of businesses in your community will reveal which ones need your help. You can handle branding and customer service for a monthly fee.

You negotiate your rate in this situation. As a result, your rate may vary by location. Social Media Strategies Summit suggests $15 to $50 per hour for newbies; $50 – 100 per hour for intermediate; and $120 – 250 for advanced.

Transcriptionist

This is a fit if you can type fast and accurately.

Often transcriptionists work on court records and insurance claims. However, you can find work translating videos, movies, etc. if you have a second language.

Lionbridge, Net Transcripts, Rev, and TranscribeMe are a few of the companies that hire transcriptionists. Most companies report rates in the $15 to $25 per audio hour range.

The above is a random sampling of side hustles. You can search the internet for more, ask friends, or just sit back and think of a need someone might have that you can fill. The possibilities are endless.

Read More

- Save An Extra $3,339.75 This Year with the 365 Day Nickel Challenge

- Save Money Easily with the 365 Day Quarter Challenge

- 10 Great 52 Week Money Challenge Alternatives

Come back to what you love! Dollardig.com is the most reliable cash-back site on the web. Just sign up, click, shop, and get full cashback!

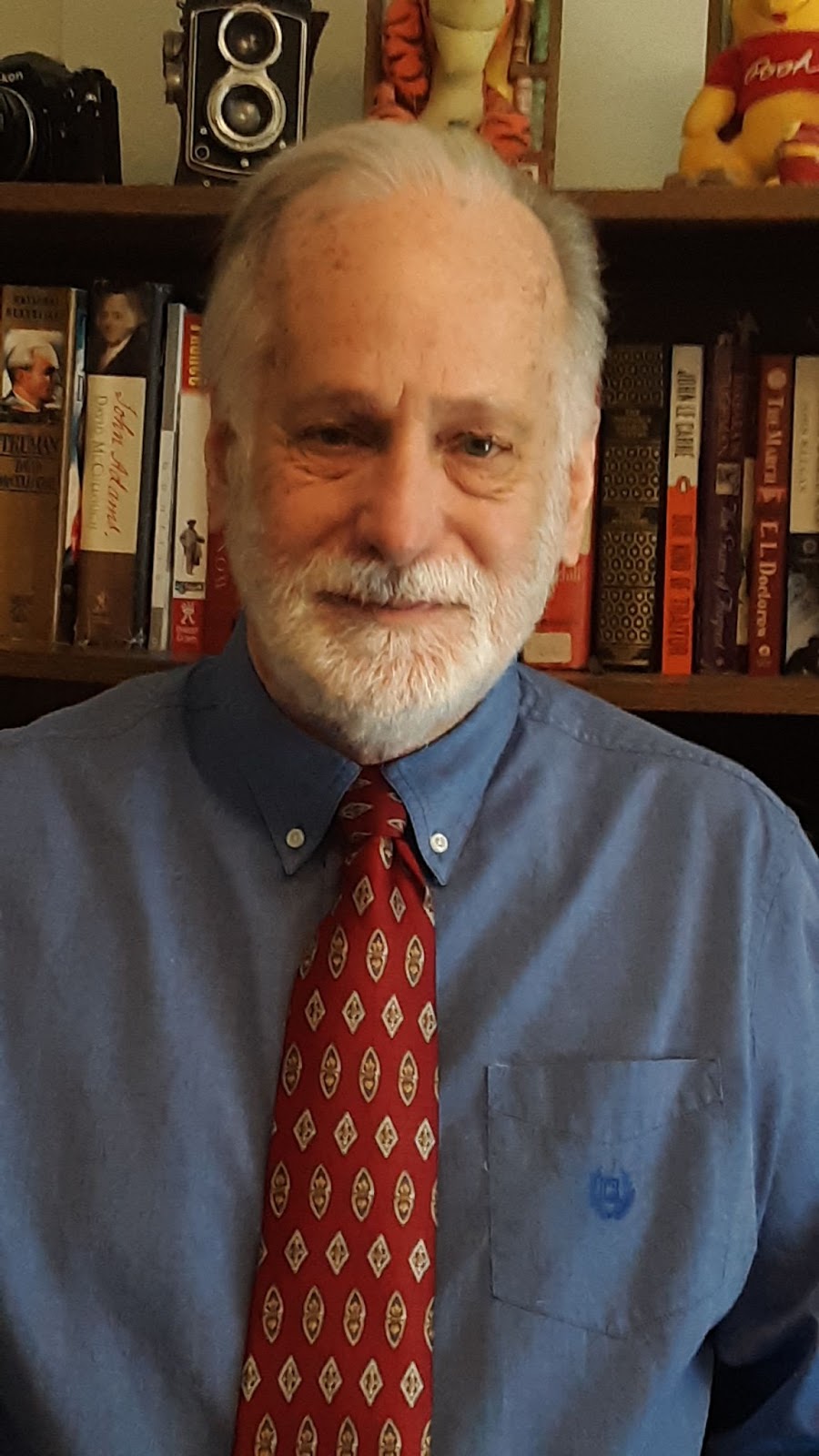

Max K. Erkiletian began writing for newspapers while still in high school. He went on to become an award-winning journalist and co-founder of the print magazine Free Bird. He has written for a wide range of regional and national publications as well as many on-line publications. That has afforded him the opportunity to interview a variety of prominent figures from former Chairman of the Federal Reserve Bank Paul Volker to Blues musicians Muddy Waters and B. B. King. Max lives in Springfield, MO with his wife Karen and their cat – Pudge. He spends as much time as possible with his kids, grandchildren, and great-grandchildren.

Comments