In a recent blog, a mom from Alaska shared her family’s six-figure debt to get some advice and support.

She and her husband have about $232,000 in debt spread across multiple credit cards, car notes, and student and personal loans.

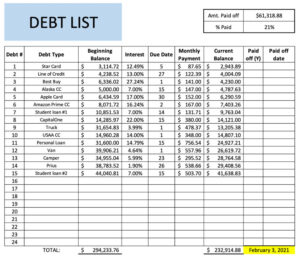

They’ve been paying down their credit cards and loans for a few years, so they started off with even more debt. Originally they owed nearly $300,000 and have paid off around 21% of it so far.

Although that’s a huge accomplishment, they still have a long way to go. Here’s a spreadsheet that shows all of their debts and monthly payments.

When you tally up the amount they owe every month, it comes out to a whopping $4,807.

They’re spending about $57,000 per year just on debt service, which is likely causing huge amounts of stress. Not to mention edging out other financial goals like saving for retirement and their children’s college funds.

How did this happen, and how can they climb out of this hole?

How Does This Happen?

TheBudgetingNerd mentioned in her post that her husband keeps charging up the credit cards. It seems like he doesn’t know how to live within his means, which caused them to accumulate a huge pile of debt and keep adding to it.

Unfortunately, they’re not alone. About 80% of Americans have consumer debt and the majority of us live paycheck to paycheck.

Some Americans have debt because the minimum wage hasn’t kept pace with inflation and they can’t afford the basics. But if you make a decent income and have credit card debt, it’s time to take a hard look at your budget before things spiral out of control as it did for this family. It may also be the case that this couple has a spending addiction and might want to consider professional help.

Getting Out of a Six-Figure Debt

One of the first things that TheBudgetingNerd has to do to tackle this debt is communicating with her husband and get him on the same page. They can’t dig themselves out if he continues overspending, so he needs to adjust his lifestyle.

There are also four vehicles listed on the spreadsheet, but only two drivers in the family. Downsizing and getting rid of two of the cars would eliminate a lot of debt.

One commenter pointed out that the balance on their high-interest Capital One Card hasn’t changed much in the years they’ve been paying down their balances. They suggested using the snowball method and tackling the highest interest debt first, which could help them make more progress.

TheBudgetingNerd also said in the comments underneath the post that her husband is in the military. Active duty service members usually qualify for lower interest rates from credit issuers, so taking advantage of those programs could help lower their monthly payments.

Another plan they have is to move into their camper so they can use their $2,253 housing allowance from the military to pay down their debt faster. This is a big sacrifice considering they have 3 kids, so I really applaud them for this.

If they get lower interest rates on their credit cards, move into the camper, and get on a strict budget, they’ll be able to tackle their debt much more effectively.

If you enjoy reading our blog posts and would like to try your hand at blogging, we have good news for you; you can do exactly that on Saving Advice. Just click here to get started.

Check out these helpful tools to help you save more. For investing advice, visit The Motley Fool.

Vicky Monroe is a freelance personal finance and lifestyle writer. When she’s not busy writing about her favorite money saving hacks or tinkering with her budget spreadsheets, she likes to travel, garden, and cook healthy vegetarian meals.

Comments