When is the best time to take your Social Security benefits?

As with so many tricky decisions, the short answer is, “it depends.” According to the Center for Retirement Research at Boston College, far too many people are taking benefits too early. Those taking their benefits beginning at 70 or later are in the single digits, percentage-wise.

It’s no secret that the retirement savings situation in the United States is pretty bad. So it makes sense that a lot of people are going to be counting the days until they’re eligible for that first payment.

By choice or not. If you’re heading into retirement and wondering how to make ends meet, then you probably need the money as soon as possible.

But if there’s any doubt — that is, if you can possibly see a way of making ends meet without those benefits — then you’ll want to run some numbers before deciding what and when to take.

Most people are in this boat. They don’t have the kind of money where it’s a no brainer to wait as long as possible to take the benefits. They do, however, have investment accounts and at least some kind of road map that gets them through retirement without running out of money. It’s these folks who often have the best of intentions but make the wrong move by taking Social Security early instead of drawing down on their investments.

There are various reasons people have for making this choice — one is taxes. Investors go to great lengths to avoid capital gains taxes, which they would surely incur if they have been good about saving the past couple of decades. Another is just the force of habit. People with great savings habits sometimes have a hard time doing a 180 and spending down their investment accounts.

But that’s often exactly the best course of action: Spend some of what you’ve saved, take the tax hit, and wait on Social Security. Read on to learn why.

A Stream Of Cash Flows

You’re probably familiar with annuities. What you may not realize is that you have already bought one.

In case you’re not familiar, annuities essentially work like this. You pay into an annuity, often as a lump sum, and in return receive a guaranteed income stream for a defined period of time. That income might have some bells and whistles attached too, such as a survivor benefit — if the recipient dies, the spouse or partner could get some percentage of the payments going forward for some stretch of time.

We won’t get into the debate about whether annuities are good or bad, but we will say that, for the risk-averse, that guaranteed income stream can provide a lot of peace of mind. There’s always the chance that the company that issued the annuity will go out of business, but that’s really rare. Most states have state guaranty associations that serve as backstops if those companies fail.

With Social Security, the chances of default are even slimmer as it’s backed by the U.S. government. Could benefits be cut one day? Possibly, and it’s worth considering what that would mean to your retirement plan. Social Security, however, can be thought of as an extremely safe annuity contract. It just happens to be a contract that most full-time workers have no choice but to take.

For argument’s sake, though, let’s say you get to near-retirement age without having paid into Social Security and decided you would really like that level of confidence in an income source. So you start annuity shopping.

In short, it’s going to cost you. Let’s say you and your spouse are at age 60 and would like a source of $1,000/month with survival benefit starting when you’re 65. That annuity is going to run you about $200,000, due in one payment. You can run the numbers through some online annuity calculators yourself, but this is just to give you an idea.

If, instead, you draw down that $1,000 per month from your investment accounts for five years, you are only out $60,000. Plus, you are virtually guaranteed an 8 percent annual return on your Social Security “investment,” because benefits rise by 8 percent each year that you wait.

In exchange for paying some taxes, you’re saving yourself a whole lot of money by waiting a few years to take your benefits.

Not Just About The Money (But Mostly)

Some people believe they have a good idea about what their life expectancy will look like. If they are fairly certain that they won’t make it beyond, say, their 70s, they might have reason to take the benefits earlier — even if they don’t really need them.

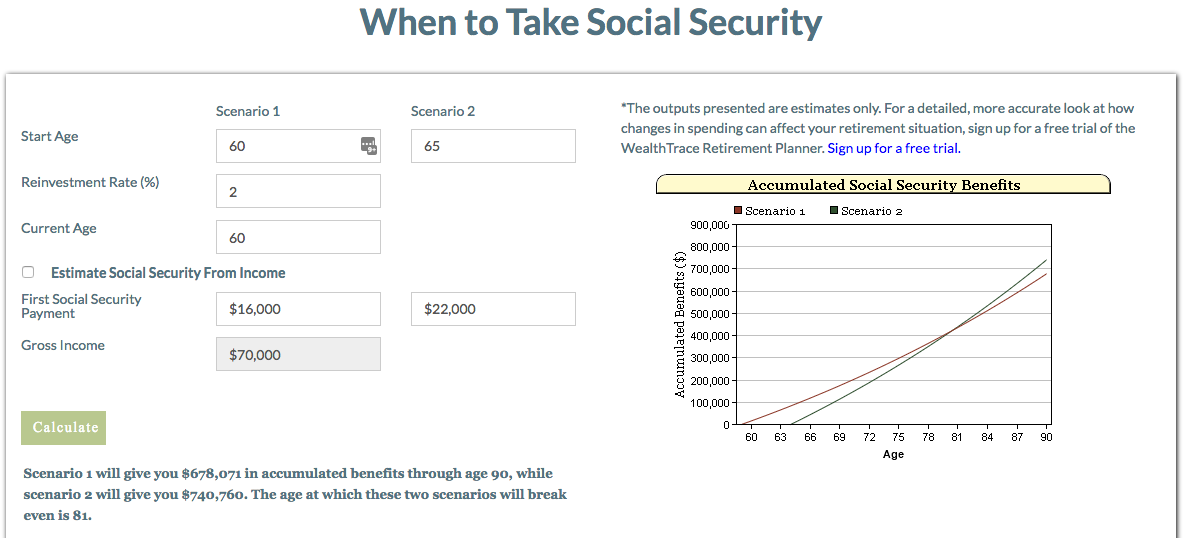

There are calculators that can help you determine when your “break-even” age will be. This refers to the age at which you make up for taking your benefits early. In other words, if you start taking your benefits early, you’ll have to live to a certain age to get to the point where you get the same amount of benefits as someone who waits. Life expectancy of course factors in here too. If you have a strong belief that you’ll live past the break-even age, it’s normally going to make sense to wait to take the benefits.

Knowledge Really Is Power

The decision — the very permanent decision — about when to begin taking Social Security benefits is just one piece of the retirement puzzle. The pieces need to fit together to have a successful retirement plan — broadly defined as not running out of money, but probably encompassing a lot more than that. Decisions you make about other aspects of retirement — from working part-time to how much in assets you want to leave to your heirs — are all interconnected. It helps immensely to be able to run your plan through a financial planning application so you have all the data in one place.

Comments