I was fortunate enough to have parents that began placing money in a 529 College Savings Plan when I was a baby. Between scholarships, working part-time between classes, and the money from that savings plan, I graduated debt free.

The fact that I took painstaking care to graduate without debt made my husband’s debt even more crippling.

For the first year, we could barely pay the minimum. Both of us struggled to get jobs right out of college and we ended up working part-time retail jobs to make ends meet.

This is where we started. It wasn’t glamorous and it took a lot of hard work but by July 2017, our fifth wedding anniversary, we will be debt free. And you can, too.

There comes a point when all of us have to choose whether we’re going to pick up that dirty load of clothes off the floor and do laundry…even if it’s not our clothes. I realized I could complain about my situation, refuse to help but then I would still have to live in a stinky situation. Or I could do something about it.

How to Pay Off Debt Fast

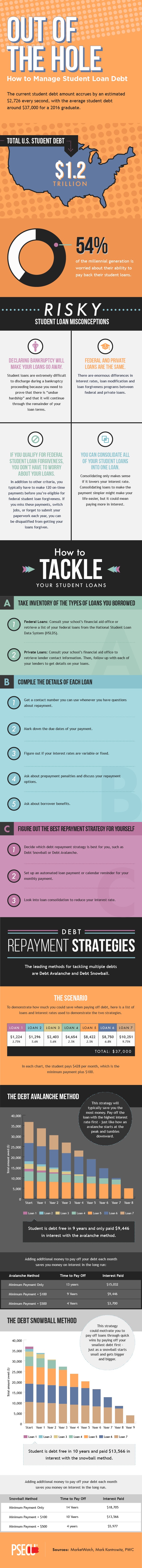

If you’re serious about paying off debt, begin by following the steps in this infographic on how to pay off student loans.

Infographic used with permission from PSECU, a Pennsylvania credit union.

To get us rolling, we started with the snowball method knocking out our smallest loan. Once we got momentum, we began following the avalanche method since it does save you the most money in interest over time.

Use this free online student debt calculator to see how much you can save by using the avalanche method over the snowball method.

The key to successfully paying of your student loans is placing all your extra money towards the principal of one loan after you’ve paid the minimum payment. Before using all of your extra cash towards debt, it’s important to save at least 6 months of your living expenses for emergencies.

Here’s how we found our extra money:

- Start a Budget: The best thing you can do right now is see where you’ve been spending your money and then create a tight budget to follow. To help you keep track of your spending, use apps like Mint or you can even just get cash out every month, place them in envelopes labelled with what they are to be used for, and only spend that cash.

- Live on the Bare Minimum: We lived in a tiny apartment, the cheapest one we could find. We didn’t buy anything we didn’t need. When my husband’s car broke down, we bought one we could pay for upfront. We rarely ate out. I found healthy recipes that didn’t require a lot of ingredients. We didn’t take vacations, unless offered to us for free by family. You have to see this time of your life as temporary. Never accept your debt as a way of life. We lived very much like minimalist during the first four years.

- Change Your Mindset: Control over your mind is the secret sauce in life. Instead of grudgingly saving, we prided ourselves on our frugality. There’s a lot we could have complained about when paying off debt, but instead we decided to focus on the future. We adopted Dave Ramsey’s mantra: “Live like no one else now so later you can live like no one else.”

- Stop Habits That Throw Away Money: This is really where we saved the most money. We never bought alcohol. I opted to make coffee and tea at home instead of buying specialty drinks at coffee shops. We didn’t buy cable. We went to the movies maybe once a year. For fun, we would read or play board games with friends.

- Pick Up Extra Jobs: We didn’t have much free time, because we spent all of our time working. We were okay with this since we knew it was temporary. My husband got a job as a personal trainer but kept working part-time in retail till he had enough clients to work all day. I also got a job at an agency but still work weekends as a party entertainer for children. Typically, the longer you work your salary increases. In our second year, we were able to consistently pay $200-300 extra each month toward one of the loans. As our raises grew, we paid even more. This past year, we averaged $2000-3000 toward loans each month.

- Celebrate the Wins: Just because you’re frugal doesn’t mean you can’t celebrate once in a while. Whenever we knocked out a large loan, we would celebrate with a special meal or tell a family member who we knew was cheering us on. We’re also planning a big vacation at the end of this year to celebrate our freedom from debt.

The biggest hurdle I see in people’s lives when it comes to debt is not that they don’t have money to put towards debt, but that they don’t see debt as a serious problem. Why not just pay the minimum payment and let debt eventually go away?

First off, you’ll save thousands of dollars in interest by choosing to accelerate your debt payoff plan. Secondly, if you’re honest with yourself, debt is an invisible chain and ball wrapped around you. It can cause family issues, strife, and unnecessary stress in your life. Why live with that shadow over your head longer than you have to?

Get debt free and live the life you’ve always wanted.

Comments