Having a savings plan in place helps to keep your funds moving in the right direction. You will feel much better and more secure knowing that there is some sort of cushion should you get into a pickle. While these savings challenges are not the end-all solution to financial woes, they are a great start.

If you are able to manage juggling a job during your studies that pays every other week, the 26 Bi-weekly Money Challenge may be just for you.

If you have heard of the 52-week Money Challenge, this one will not be too foreign to you. In the 52-week challenge, you increase your dollar amount each week by one dollar starting with $1 deposit into savings. Typically, the challenge is started at the start of a new year to follow each week. For example, during the first week of January, you deposit $1, then $2 the second week, $3 the following and so on.

The 26-week Money Challenge is just like the 52-week one, except you pay two payments at a time. Instead of depositing money weekly, you only set aside funds bi-weekly as you are paid. College students may find this money challenge more appealing due to not putting money forward every single week.

The 26-week Money Challenge

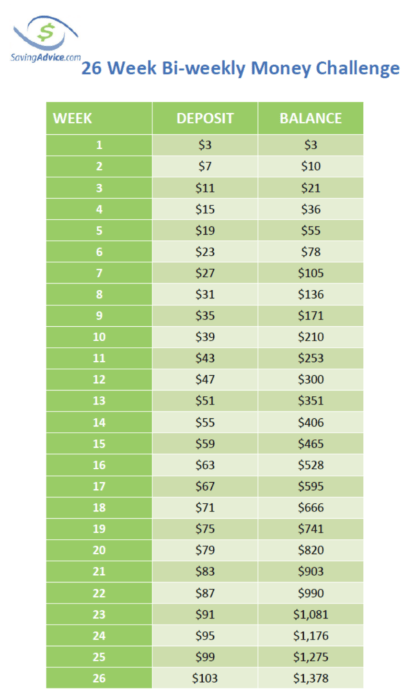

By the end of the year, you will still have saved the same amount of $1,378 as the 52-week Money Challenge. The main goal with the 26-week challenge, though, is to help make it more manageable for you. Here’s how it works:

- Your first payment will be $3, the total from week one of $1 and week two of $2.

- The next bi-weekly deposit would be $7, from weeks three and four of $3 and $4.

- Come the third bi-weekly payment, you would pay $11, $5 for the fifth week and $6 for the sixth week.

You get the idea, right?

The most difficult thing about this challenge may be that as you begin to reach the end, you are also reaching the holiday season (if you start at the beginning of the year). A great alternative to this situation would be to start with the highest amount and work your way down so that by the holiday season, you are only putting away a few dollars instead of $100. You could also choose to alter the amounts you deposit based on your income and budget, but we recommend the amounts provided to really get your savings account started.

You can download a blank printable version of this challenge here.

Ultimately, the goal of a money challenge like this is to help you create a habit and keep your finances at the top of the mind in order to get ahead. Another important concept to keep in mind and begin becoming comfortable with now is paying yourself first. This will help to make you successful in keeping up with this savings challenge and others like it as well as your overall financial plan.

There are other money challenges you can try as well, if you feel this does not fit you.

So, now it’s your turn. Will you be trying this savings challenge?

Comments