Life expectancy tables are easy enough to find on the web. But it’s trickier than just finding a number. You don’t care what your anticipated lifespan was when you were born; you care about what it is for you today. If you’re reading this, you have made it past most of the early dangers that reduce overall lifespan numbers, so those numbers should not matter to you very much.

In other words, you have survived–and so it is likely (to a point) that you will continue to survive.

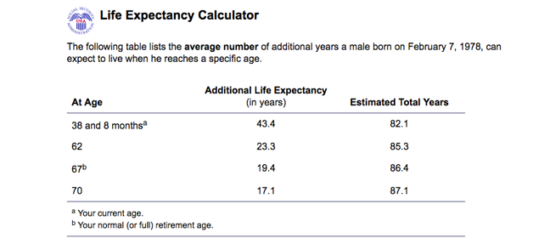

This Social Security Administration life expectancy calculator can help illustrate. You can punch in your birthdate and gender and SSA will give you a life expectancy number. Take that number with a grain of salt, of course: It’s an average, and does not account for your specific health and genetics.

Source: Social Security Agency

In this case, a 38-year-old male can, today, expect to live to 82. The point to note, though, is the trend in the “Estimated Total Years” column. When today’s 38 year old makes it to 62, that number bumps up to 85; at 67, it’s more than 86. Again, up to a point, the longer you live, the longer you can be expected to live.

Your life expectancy figure is a moving target–definitely not a set-it-and-forget-it thing. That makes things trickier for the purposes of retirement planning: It’s hard to plan for having enough money to last for the rest of your life when the rest-of-your-life number keeps moving.

You Say ‘Uncertainty,’ I Say ‘Flexibility’

One way to handle this moving target is to just plan for what seems like a really conservative life expectancy number. That could be 100 years old, or 105. If you plan for the worst and hope for the best, you should be in good shape, right?

The trouble with this approach is that it could (and most likely would) lead to your working more years than you really need to. Yes, you have certainty (or as much certainty as you can have with this topic) that you won’t run out of money, but is it worth it if you have to work five or 10 or even more years than you otherwise might have (and then die much earlier than 100)?

There is another way. If you can be flexible in your thinking about what you will spend in retirement, you can be more realistic about your life expectancy number–and adjust it along the way as needed.

Here’s what we mean. Conventional wisdom used to say that, to retire, a person with a roughly 30-year time horizon should have a portfolio balance that will allow him or her to withdraw 4% of the portfolio’s value per year, and generate 80% of their pre-retirement income. The so-called “4% Rule” has fallen out of favor in recent years for a number of reasons, not least because fixed income yields are so low. Regardless, the rule should only really have served as an estimate in the first place. It’s not just life expectancy that’s uncertain when it comes to retirement planning. Markets can plunge, economies can stagnate, and inflation can eat away at savings. On the other hand, economies can get hot and the stock market can go along for the ride.

Very little of what markets and economies will do is predictable in the short term. To absolutely plan on the same withdrawal rate, year in and year out, regardless of what the markets are doing, is almost irrational. Adjusting your spending behavior when times are tight, just as you likely do pre-retirement, can make your retirement nest egg last a lot longer–in addition to making intuitive sense.

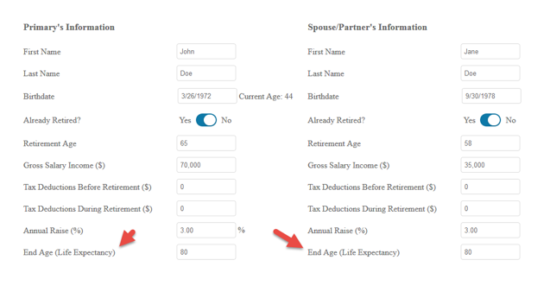

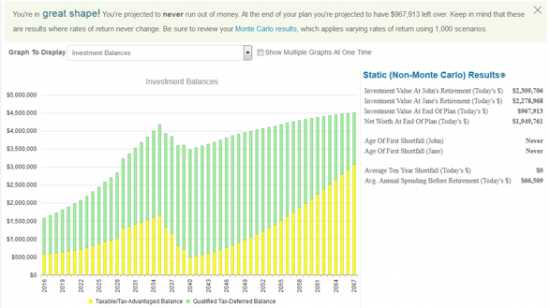

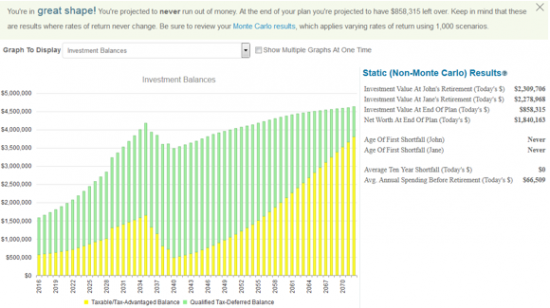

At the very least you should be running scenarios on your life expectancy in an accurate retirement planning solution, such as WealthTrace, which is available to the public. You can see below how one can change the life expectancy and then view the different results.

Still, in retirement, the less uncertainty about where your money is coming from, the better. This is where dividend-paying stocks can make a big difference. There are companies that can be counted on to pay–and even increase–their dividends year in and year out, regardless of what the stock market is doing. In the event of a market correction, their stock prices will likely drop along with the rest, but that won’t matter–the dividends should keep coming. We have found in our research that, using Monte Carlo analysis, investing in the best dividend paying stocks can improve your probability of never running out of money by more than 20%!

Here are a just a few companies with long histories of increasing their dividends annually, and there are plenty more like them:

| Name | Ticker | Yield (as of 10/14/16) | Consecutive Years Increasing Dividends |

| Altria Group | MO | 3.7% | 47 |

| Chevron | CVX | 4.3% | 28 |

| Coca-Cola | KO | 3.2% | 54 |

| Southern Company | SO | 4.3% | 16 |

| Target | TGT | 3.4% | 49 |

Let’s Be Realistic

We become more rigid in our thinking as we age. So it might be tough to consider being flexible about something as important as income and spending in retirement. But a certain level of flexibility can lead to more realistic expectations about what we need to save, and could even lead to an earlier retirement.

Comments