For years my money management system consisted of a patchwork of tools. I have a monthly budget worksheet which totals income and expenses and details when each expense is due. I also have a spreadsheet in which I inconsistently attempt to track my spending by category. Finally, there are the online logins to different financial accounts that track my savings, lines of credit, and investments. I have a document saved on my computer that contains all those websites, user ids, and passwords. It would be fantastic to have all that information in one place visible on a single screen. If you’re in the same situation, Personal Capital might just be able to help us both out.

To help you get better acquainted with Personal Capital, this post will cover the following:

- An overview of Personal Capital, how they operate, and some of their philosophies.

- A recap of my own personal experience with Personal Capital.

- A summary of both the free tools and paid services offered by Personal Capital.

- My personal observations and thoughts regarding Personal Capital.

About Personal Capital

Personal Capital is an online financial advisor and money management platform. Their client centric business model blends technology and objective financial advice to give customers the best possible money management experience.

They believe everyone should have a sound investment strategy that is customized to your situation and goals. They are not looking for the next home run. They believe that taxes and fees matter, so they work hard to minimize both.

Their website claims Personal Capital outperforms the S&P by 1.5% annually, and does so with lower volatility.

Personal Capital offers an impressive suite of free money management tools that users can take advantage of simply by registering with their website. If they chose, users can take it to the next level with paid services such as one on one time with a financial advisor, and having Personal Capital manage their investments.

Personal Capital Security

To use Personal Capital, you will be supplying account details allowing the application to import your financial information. The encryption used by Personal Capital earned an A rating from the world-renowned Qualys SSL Labs, a stronger rating than most major banks or brokerages.

Other security measures implemented by Personal Capital include:

- No individual at Personal Capital has access to your credentials

- Each device used to access your account must be authenticated

- Extra mobile protection on iPhone with Touch ID authentication, and mobile-only PINs on iOS and Android

- WhiteHat Security performs around-the-clock security testing on our site

- Personal Capital operates under SEC (Securities and Exchange Commission) jurisdiction and is audited for compliance with SEC cybersecurity regulations

Personal Capital Investment Funds

Users that decide to invest through Personal Capital will take advantage of an investment strategy that uses a high degree of diversification and the lowest fund costs. Personal Capital purchases US funds from a well-diversified sample of over 70 individual stocks, providing the advantages of their Tactical Weighting approach tax optimization strategy. A combination of low-cost exchange traded funds (ETFs) is used for fixed income strategy.

Personal Capital Fund Liquidity

Personal Capital purchases highly liquid securities. If needed, cash can usually be made available within 1 to 3 days.

Personal Capital Funds Holder

Personal Capital never directly takes custody of your funds. Personal Capital uses Pershing Advisor Solutions, a Bank of New York Mellon Company, one of the largest US custodians with over a trillion dollars in global client assets.

Minimize Tax Impact Using Personal Capital

Personal Capital works to minimize the tax impact of your investments through several techniques:

- By using individual securities, gains in some securities can be used to offset losses in others. This is called tax-loss harvesting.

- Avoiding tax-inefficient mutual funds.

- Asset location. For individuals with both taxable accounts and retirement accounts, this means placing the right investments in the right accounts. High-yielding stocks and fixed income generally go into tax-deferred or exempt accounts. REITs pay nonqualified dividends and should also be owned in retirement accounts.

Personal Capital Rebalancing

Investment accounts are reviewed daily for rebalancing opportunities. Rebalancing is considered for high level asset classes with a deviation of 0.5% from targets, and individual securities when they deviate a few percentage points. A disciplined rebalancing strategy is an important aspect to help investors meet their long term goals.

Using Personal Capital

After learning some specifics about Personal Capital, I wanted to try it out for myself. As mentioned, Personal Capital allows free use of their online money management tools. Here’s my own personal experience with registering and using these free tools.

Personal Capital Account Creation

Creating my account was extremely quick. After entering my email, personal information and selecting a password, my account was created and I was ready to get started.

Linking Accounts on Personal Capital

The next step was to link my financial accounts with the Personal Capital platform. Similar tools I’ve used in the past would require the error prone and tedious entry of long account numbers. Personal Capital only required me to identify the financial institution, my user ID and my password. It gathered information for all accounts managed by each ID and imported it into the Personal Capital dashboard.

For example, when I entered information about my online Wells Fargo ID, it imported information about my checking account, mortgage, and personal loan. When I entered online account information for Fidelity Investments, it seamlessly imported my pension and a detailed breakdown by fund for my current 401K account. It was even able to easily find and import information about my secondary savings and checking accounts from a small regional bank.

Removing Accounts on Personal Capital

The Personal Capital money management platform does such a comprehensive job of importing information, that sometimes it grabs more than you would like. For example, it also imported my son’s account information from Wells Fargo since I’m listed as a secondary account owner. Fortunately, the platform has a way to easily edit your account list, and remove such accounts from the dashboard.

Manually Adding Assets on Personal Capital

To get a complete financial picture, you may have to manually add some of your assets. For example, adding my mortgage account takes care of the debt side of the equation, but doesn’t add the true worth of the home to my assets. By entering my address into the tool, it used Zillow to get an approximate market value of my home, and added it to my financial dashboard.

Personal Capital Free Tools

Your Net Worth

A common piece of information that many people want to know is their net worth. With all of your accounts linked, and any assets you have are added manually, Personal Capital does the math and displays your net worth. Your net worth is constantly recalculated, taking into account any additions or subtractions to your accounts as well as any change to your investments due to the effect of the current day on Wall Street.

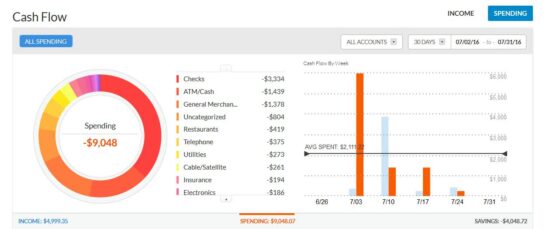

Tracking Transactions on Personal Capital

Personal Capital provides a wealth of tools that can be used to help manage your day to day finances under the Transactions section. Users can choose to see all transactions to every accounts on one screen, or to see a view of just income or just spending. The tool categorizes each transaction, but allows the user to alter the category of a transaction for accuracy. These categories are totaled showing users exactly where their money is coming from, and what they’re spending it on. Another view even shows users bills that are due in the near future along with the payment amount required.

Personal Capital Portfolio

Personal Capital also provides tools that show users information about their investment portfolio including the balance of each account, breakdown by type of your investments (stocks, bonds, cash, etc.), as well as the recent performance of each type of investment. One thing I noted here was the performance analysis appears to be from the time the information was imported into the tool, therefore a new user will not be able to see recent performance information.

Personal Capital Advisor Tools

The Retirement Planner will help users ensure they’re on the right path for retirement by comparing their projected income in retirement against the inputted spending projections.

Many investors aren’t aware the some investment categories in their 401K have fees charged by their investment manager. The 401K Fee Analyzer helps educate users as to how much of their hard earned cash is being paid out as fees. Users could choose to move their investments to funds that have lower fees, maximizing the growth of their retirement nest egg.

Personal Capital Mobile App

Users can access their data on the go through the use of the free mobile app available for both IOS and Android users.

Personal Capital Paid Services

Once a user registers with Personal Capital, a financial advisor is assigned. I was given the name, as well as some background information, and a picture of my assigned advisor the day after I created my account. Scheduling a personal phone call with my advisor is as easy as clicking a button and selecting an available time slot. The annual fee charged to take advantage of Personal Capital’s services is a percentage of the assets managed:

First million: 0.89%

First $3 million: 0.79%

Next $2 million: 0.69%

Next $5 million: 0.59%

Over $10 million: 0.49%

There are no trade commission fees. Personal Capital bills monthly, and routinely helps clients with financial planning and 401(k) allocations at no charge.

Personal Capital Observations

- Free Tools: The amount and quality of free tools offered through the Personal Capital website is impressive. I’ve never had all my financial information viewable in one place before, and the ability to run the free analytics is unbelievable. I honestly can’t believe they are giving this level of service away for free.

- Online Help: While logged into the website, there is a handy Help tab on the right side of the screen. Unfortunately, the interface has users type in a question which then prompts a search for information within the site which didn’t give me the results I would expect. The good news it there is another link to help on the bottom of each page which gives a much more comprehensive level of help for getting set up and understanding the tools available, and the information displayed in each of them.

- Easy Onboarding Process: Creating an account and linking my accounts was extremely easy. It literally took me less than 15 minutes to get all my accounts linked into the website

- Security: Given the amount of security implemented by Personal Capital, I feel very comfortable that my information is safe.

Personal Capital Analysis

Personal Capital attempts to lure customers in by providing top notch day to day money management tools. Once customers get all their accounts linked in and see the wealth of tools and analytics, they hope customers will go to the next level by signing up for their investment advisor service and either move their investment accounts to personal capital or being to invest through them. They want to become your one stop shop for all your financial management needs. I highly recommend checking out Personal Capital to check your financial health. It’s easy to setup, easy to use, and they might just help you better your financial future.

If you are interested in Personal Capital, you can Join for Free.

Comments