Apple (AAPL) is down a crushing 30% from its peak. It has been a rough year for Apple investors. But there is good news in this serious decline; Apple’s dividend yield is now 2.4%

Yes, Apple Does Pay A Dividend

Most people forget that Apple is now paying a dividend. The yield wasn’t much to write home about when the stock price was near $130 a share. But at $94 a share today, the dividend yield is starting to look very enticing.

Not only is 2.4% a better yield than most of the stocks in either the Nasdaq or S&P 500, but Apple has the cash flow, low payout ratio (only 23%), and cash on hand (over $130 billion) to easily increase this dividend by double digits for decades to come.

Apple’s Dividend Potential

This could be a huge opportunity to add Apple to your retirement portfolio. The real play here is on the consistent dividend growth over time. Over a 20 year (or longer) time period, the dividend growth and yield on a stock like Apple will render the price fluctuations unimportant if you are investing for income. I will show this with an example.

Using a our dividend calculator I was able to see what Apple could return under various scenarios. I started with these assumptions:

Using these assumptions, over a 20 year time period Apple would return 318%. This is an annualized return of 7.4%. Even if the dividend growth rate only comes in at 9%, the compounded return over 20 years would be 246% with an annualized return of 6.4%.

Unlike the previous 20 years, the strong returns from Apple for the next 20 years are likely to come from its dividend, not its stock price.

Apple For Retirement Portfolios

Apple is now primed to be a major contributor to your income in retirement. Finding good sources of retirement income is very difficult today with low interest rates and lofty stocks prices.

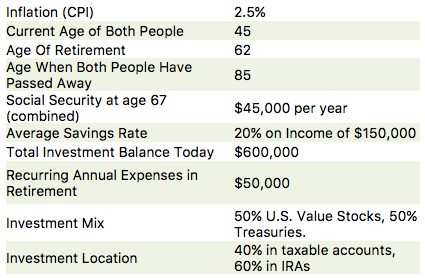

Let’s take a look at an example of how Apple can change a retirement portfolio. I started with some assumptions and ran this in the WealthTrace Personal Financial Planner, which takes into account all account types and tax rules, unlike most free retirement calculators you find online.

Here were my assumptions:

I started with the fact that this couple’s stock portfolio is invested in equities that return 6% per year. The goal here is to have enough income produced in retirement so that they never have to dip into their investment principal. If one can live off just income in retirement, then there is no chance of outliving your money.

Unfortunately for this couple, their income will not cover their expenses as you can see in the chart below.

But what if we took half of the money they have in treasuries and half their current stock investments and put it into dividend payers like Apple? I’m not saying investors should put 50% of their money into one stock of course. But we should be seeking out more stocks like Apple with a solid dividend yield and the strong potential of years of dividend growth.

So if we move half of their money into stocks that have a 2.4% dividend yield and a dividend growth rate of 12% per year, we see a dramatic improvement.

Because of the growing dividends over time, this couple is now living off income in retirement.

It’s About The Long Run For Retirement

Given enough time, companies like Apple can set you up for retirement. The key is the consistent and growing dividends. There aren’t many companies that have the ability to keep growing their dividends at a double digit clip like Apples does. This is a rare opportunity, especially with very few places to find decent income-producers in retirement.

Photos: Doug Carey

Comments