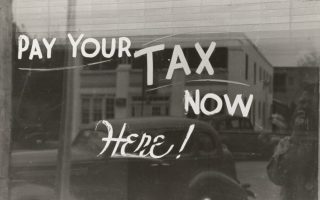

Every year, we file our typical W2’s, 1099’s and other tax forms to please the IRS. If you follow SavingAdvice, you might be aware of some of these write-offs. But, the next time you go to file, you might want to also keep these strange tax deductions in mind:

- Your gym membership. Sure, exercise is rewarding on its own, but did you know it can also be tax deductible? If your doctor is recommending exercise for your health, you could have a write-off on your hands. Additional write-offs could include any costs used to help improve your cholesterol, weight and the like. Just make sure your doctor is signing off on it.

- Your swimming pool. Swimming pools are nice, but they are also a daunting expense with upkeep and maintenance and, sometimes, repairs. However, if you have a medical condition with which a swimming regimen helps to improve, such as arthritis, your pool expenses may count as a deductible medical expense.

- Moving with your pets. You may already be aware of moving fees counting toward a write-off on your taxes if it is for a new job, but relocating with your pets qualifies too. Bills that may accumulate from moving to your new home with pets can count toward this deduction.

- Music lessons. Music lessons, specifically clarinet lessons, can be a write-off due to this 1962 case, mentioned on page 89 of this file, when an orthodontist argued that playing the clarinet could help with a child’s overbite and would, thus, be considered a medical expense.

- Butting out. The perks of quitting smoking go beyond improving your health. The IRS may permit the deductions of any smoking cessation programs, patches or aids that you use to kick this habit.

- Temporarily renting your space. If you rent your home out to guests for less than 15 days per calendar year, the related income from such an exchange would be tax-free. So, if you live in a prime destination spot or have been exploring the idea of signing up for airbnb, this one’s for you.

- Clowning around. Parading around with giant shoes and a red nose just became a little more enticing. If you chose the clown life, your costume and gear for such a position is tax deductible. Why? It’s not an outfit that is usable outside of a clown gig.

- Childcare during charity work. While not necessarily a traditionally “strange” deduction, if you are involved in charity work but need childcare during hours serviced, you can deduct the costs from you 1040.

- Pets. Yes, that’s right; overhead of care for your “furbaby” may be considered a write-off if the animal is used for business.

- Sex-change operations. If it can be deemed medically necessary, such as a gender-identity disorder, you may be able to deduct a large portion of expenses toward the procedure, such as hormone therapy and sexual reassignment surgeries. However, breast augmentations, in this case, are not due to being considered a cosmetic surgery.

The lesson here? Some cases are more specific than others, but a rule of thumb to follow is if the expense can be proved medically necessary or business-related, you may want to look into what tax deductions are available for such costs.

Have you been able to take advantage of any of these strange write-offs?

Comments