You’ve heard of Dave Ramsey. He’s the guy who preaches, “Debt is dumb. Cash is king!” on his nationally syndicated radio show. It’s aptly named The Dave Ramsey Show. He is perhaps the country’s most famous personal finance guru – right up there with Suze Orman and Clark Howard.

But just a few short decades ago, he was broke. He lost all his money in real estate. However, just last year, he bought a new house. Brace yourself for the following stats. The living quarters are 13,307 square feet with a garage space of 1,454 square feet. This means his garage is bigger than most homes in Sweden, France, Germany, Greece, Spain, Italy… I could go on.. The house is rumored to have a wall of whiskey barrels in the basement, 18 shower heads in the master bathroom, and an impressive media room. Leann Rimes used to live in the neighborhood.

Dave bought this new house for a cool $5 million. It’s a massive chunk of change. But he stayed true to his beliefs that “Debt is dumb.” The house has no mortgage.

What Dave Ramsey often preaches is that buying nice things isn’t a sin – if you can afford them. He encourages people to buy Tesla’s, Yacht’s, etc. if they can afford to (while still tithing to their church). He says instead of looking at the cost of an item, look at your net worth. Think percentages.

Think of it in terms of vehicles… according to the famous personal finance book, The Millionaire Next Door, most millionaires spend about 2% of their net worth on cars. That’s $20,000. Dave says that a $20,000 is perfectly appropriate for a millionaire. However, a college student shouldn’t dare consider a $20,000 car.

To put Dave’s house into perspective, Dave Ramsey has a net worth of about $55 million. That means his house is less than 10% of his net worth. It’s just over 9%. This means he can easily afford the house. According to Bloomberg, US homeowners have 67 percent of total wealth wrapped up in housing.

How Dave Ramsey’s Net Worth Will Increase

Dave Ramsey’s net worth is $55 million. His home is worth $5 million. We don’t know how much of his worth is wrapped up in his business. We don’t know how much income it generates. But we know his benchmark when it comes to investing. According to Dave, anyone can invest in the stock market and expect a 12% return on their money. For more information on that, read his article titled The 12% Reality.

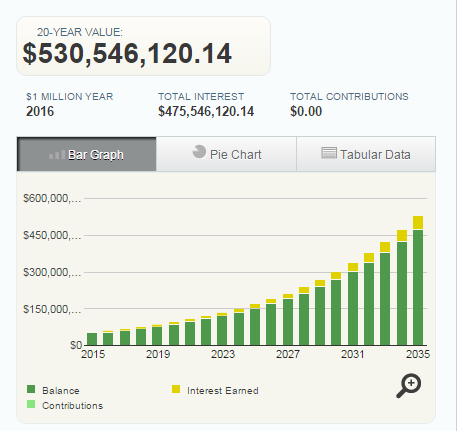

We can assume that Dave makes at least 12% annually on his money invested in his business, The Lampo Group, Inc. Using 12% as our figure, let’s see what his net worth will be in the future. After all, we want to keep this article up-to-date:

By the year 2016: $61,600,000

2020: $96,928,792.58

2025: $170,821,651.46

2030: $301,046,116.77

2035:

Ah, the beauty of compound interest. The rich get richer. Of course, keep in mind this is back-of-the-napkin math. It simply uses his current estimated net worth + gains of 12%.

Bottom Line

Dave Ramsey is VERY rich. He’s a far cry from his listeners who are typically swimming with sharks. Some say he is profiting off the poor. He charges them money to take his classes or join his forums, for instance. Surely he realizes they shouldn’t be spending money they don’t have. Or, is this okay?

Finally, if you want to get a better sense of what kind of advice Dave Ramsey is selling, consider picking up a copy of The Total Money Makeover. The book outlines some basic concepts about money and is designed similar to a self study course, so you can work through it at your own place. The book has sold more than 5 million copies – so it is worth the read. There are lots of used copies available on Amazon.com and for under ten dollars it is a solid investment in your own financial knowledge.

I’m a personal finance freelancer writer and website manager. Feel free to connect with me at firstquarterfinance.com.

Comments