Even though Apple was slow to enter the mobile payment system, it’s quickly catching up to financial companies which have tried to launch similar wallets. Apple’s great advantage is the more than 800 million users which use Apple devices and who can use the mobile payment system when launched. Apple has already collected their debit and credit data from the iTunes store, making the implementation of the service seamless for the users. Merchants, not wanting to be excluded from this huge consumer base, have been willing to adopt the new system much more readily than with other mobile payment systems. If the buzz continues and the launch in October goes well, Apple Pay could find itself the dominate mobile payment system in a relatively short period of time.

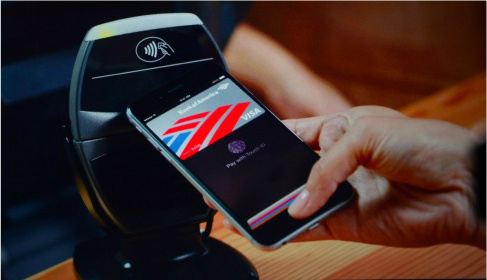

The new Apple Pay system uses Near-Field Communication (NFC) technology to securely process your purchases faster in stores. With the iPhone 6 and iPhone 6 Plus, the app utilizes several measures of security to protect your information, including a new dedicated chip known as Secure Element, and the convenience and security of Apple’s Touch ID.

The hundreds of millions of Apple users worldwide will one day soon be able to add their debit or credit cards directly from their iTunes Store accounts. Apple Pay is reported as being able to support three of the major credit payment networks, including Visa, MasterCard and American Express. They’ve also been able to get the support of some of the most popular credit issuers such as Chase, Citi, Capital One, Wells Fargo, and Bank of America.

With approximately 83 percent of credit card volume being able to push through the new Apple Pay system, retailers that will be following the Apple Store’s 258 locations will include some huge names. Places like McDonald’s, Subway, Whole Foods Market, Macy’s, Bloomingdale’s, and both the Disney Stores and Walt Disney World Resort, among several others, are expected to implement Apple Pay into their existing stores. Apple Pay is also expected to work at over 200,000 merchants who have other NFC payment systems enabled. Apple Pay is also going social media. It’s in the process of being integrated with the Twitter “Buy Now” button and the Facebook “Pay” button.

Eddy Cue, Apple’s senior vice president of Internet Software and Services has said, “Security and privacy is at the core of Apple Pay, when you’re using Apple Pay in a store, restaurant or other merchant, cashiers will no longer see your name, credit card number or security code, helping to reduce the potential for fraud.” He goes on to say that Apple doesn’t collect purchase history, so they’ll never know the who, what’s and where’s of your daily spending.

I’m a poet, an entrepreneur, a creative writer, a cynic, and most importantly, a child at heart. My personal experience working in the Financial industry as proven an asset to my industrious qualities. My control over the English language has effectively helped to persuade many opportunities into action. I seek all the knowledge I can obtain, and gladly share it with all who’d listen.

Comments