“Put everything into ________”

Fill in the blank with anything you like; if you’re talking about investments, this is bad advice. Any investment involves risk and you need to have a fallback plan if things go south. The plan may be something as simple as holding some cash in reserve if you don’t want to build a diverse portfolio.

“Use a secured loan to borrow investment capital”

Using borrowed funds can be a good leverage strategy and there’s always the chance that it will pay off. In fact, the numbers are almost always in your favor if things go well. The down side is that you increase your risk and your losses if they don’t. If you’re using collateral to secure the loan, you’re putting it at risk, too. Smart investors borrow only if they have an easy source for the funds.

“Buy into new internet IPOs”

Not every new internet company is going to have the success that Google has. In fact, most of them are consistent losers. New internet companies get a lot of publicity, so they’re tempting. Don’t get talked into investing in one just because it’s new.

“Put some funds into a leveraged EFT”

Chances are this advice will come from someone who made some money on one several years ago. Top financial advisors agree that today’s serious investors need to avoid this type of EFT. You don’t even need to know how they work; all you need to know is that over the long-term, you’ll lose more on bad days than you gain on good days, and because of the high leverage, the losses can wipe you out. Leave these to the day traders.

“Penny stocks are safer”

Because shares cost less, many investors automatically consider penny stocks (shares in smaller companies that sell for less than a dollar) safe. In reality, this is a tricky way to invest, because trading volume has a tremendous impact. There’s also a false sense of value in buying more shares for the money, when it simply means each share is worth less. Yes, you can make money on penny stocks, but a high return isn’t likely and you need to do some legwork before you buy in.

“Buy EE savings bonds”

Savings bonds have been a traditional gift for generations. They offer face-value purchasing and a fixed rate of return and you can invest a little or a lot. It’s also traditionally thought of as investing in the country. So, why am I saying investing in them is a bad idea? Because with a yield of 1.1% there are much better places to put your money, at least from a purely financial perspective.

“Pull your money out of (a solid company)”

If someone advises you to pull out of an investment in your portfolio that’s been delivering consistent returns, think twice. Unless there’s something obvious in the news, some loyalty may be in order. Rumors within the stock market can be disastrous, so don’t be too quick to pull your support for a company that’s made you money.

“Buy the house if you qualify for the loan”

Yes, friends, it’s still happening. Despite all the press surrounding the housing market and foreclosures, many people are still convinced that lenders base loan qualification on the buyer’s best interests. Lenders need to loan money to make money. If you can’t make the mortgage payments, the house isn’t going to be a good investment.

Any advice based on a hunch

Here’s one of those really obvious ones I mentioned in the opening paragraph. Interestingly, though, hunches, good/ bad feelings, and the like are still part of the game for some investors. Unless you literally have money to burn, investment strategies need to be based on facts. Speculation and blind faith are two very different things.

“Buy it while it’s hot”

It’s commonly accepted that buying hot stocks is the way to fast money. While there may be much to be said for using the momentum of a popular stock, it’s important to keep the risk in mind. Don’t be a lemming.

It’s only fair to note that I’m not a major player in the markets, nor do I have a huge stock portfolio. I write for a living. The opinions in this article are based on research, some trial and error and as previously mentioned, common sense. Please, feel free to disagree.

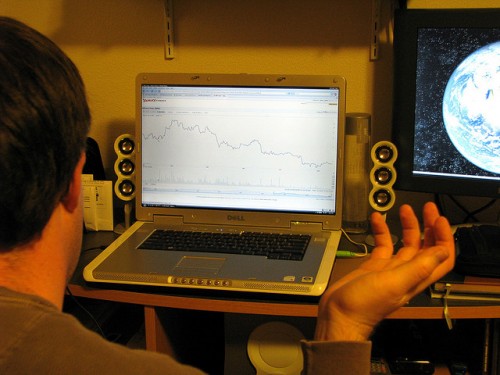

(Photo courtesy of Mr.Thomas)

Comments