Managing your money is hard and the current times make it more so. The fact is, though, it’s never been more important to get a handle on your personal finances than in today’s economy. Regardless of whether you’re a wage earner or one of the growing number of self-employed individuals, knowing where you stand financially is critical to ensure your success and perhaps even your survival in this tough economic climate. Here’s a list of important financial lessons, offered in the hope that readers won’t have to learn them the hard way.

Start and Maintain a Budget

As difficult as it may be to believe, not creating a budget is still the most common mistake people make in managing – or mismanaging, as the case may be – their money. Trying to juggle your money and bills without a budget is like performing a high-wire act without a net; eventually you’re going to fall and the damage may be irreparable. Preparing at least a basic record of how much you’re earning and where it’s going is the first and most important step in assuring financial security.

Set Financial Goals and Work Toward Them

The harder we work, the easier it becomes to get caught up in a never-ending cycle of work and rest that leads nowhere. If you’re living to work, rather than working to live, it’s probably because you haven’t set goals. We all need to be working toward something to measure our success. Think about where you want to be in 10 years, 5 years, or even next month and focus on getting there. The prize itself doesn’t matter; it could be a European vacation, early retirement or a pedicure. The point is to have a target and use your budget to get there.

Build an Emergency Fund

No matter how faithfully we plan, emergencies happen and nothing can break the budget and the bank quicker. The best way to avoid disaster is to plan for it. Emergency cash should be an integral part of your budget and it should be contributed to faithfully. It’s also important to determine your definition of an emergency. A broken garage door probably qualifies; tickets to the Megadeath concert probably don’t.

It’s Never Too Early To Invest in Your Retirement

No matter what you do for a living, chances are you won’t be able to do it forever. Most of us don’t want to. Many never have the opportunity to enjoy their golden years, even though they’ve worked hard to get there. With the cost of living soaring daily, too many individuals forced to retire end up working at least one job just to put food on the table. The way to avoid the trap is to start building up retirement funds as early as possible. Whether it’s investments, corporate plans, or simple savings, everyone needs a retirement plan.

Health Insurance is an Investment, Too

Accidents or illness shouldn’t wipe out your emergency fund or put you in debt for life. Hospital stays and medical care can devastate your finances and your credit in a heartbeat – pun intended. Be prepared for the worst with health insurance. If it isn’t provided by your company, shop around and find the best plan for your lifestyle, but don’t go without it. Like it or not, health insurance is a necessity and needs to be budgeted for.

Credit is a Double-Edged Sword

This should come as no surprise if you pay attention to the news. Over the past several decades, easy credit has been the downfall of countless individuals, families and even major corporations. There’s nothing like a credit card or line of credit to provide purchasing power. There’s also no quicker way to break that budget I keep referring to. When that happens, and you’re unable to repay the debts you’ve accumulated, you’ll find those once-friendly creditors will be closing their doors to you, as well as the door to your future. Use credit sparingly and be sure to include your payments in the budget.

Know How to File Your Income Tax Return

Even if you pay a tax preparer each year, you should know how to file your own taxes. Even the most honest tax rep or accountant is capable of making an error and if you’re not capable of recognizing when something’s not right in your tax return, you may end up losing benefits you should have received. Worse, you could end up owing back taxes with expensive penalties. You need to have at least a basic understanding of the process to avoid real trouble.

Look Before You Leap

Wise money management requires a slow, careful approach, from preparing the budget to investing and purchasing. Anything that affects your future is worth taking the time to consider and nothing will affect your future like finances. Before you buy that new iPad, consider whether there’s room in the budget, and then wait a month. If you still think you need it, it will probably be less expensive by that time. Before you invest in that new hot stock, take the time to research it. Remember your goals. “Haste makes waste” is a valuable principle in the world of finance.

Learn Not to Waste

Remember the adage, “Waste not, want not”? Unfortunately, many of us, especially in the U.S., never really learn the value of that statement. We prepare bigger portions than we should eat, make impulse purchases and forget about simple things like turning off lights and unplugging cell phone chargers and other devices around the house. We pay huge utility bills while neglecting to check and replace weatherstripping and repair leaky faucets. Learning to be frugal can make a tremendous difference in the money left over at the end of the month.

Don’t Forget the Purpose of the Budget

If it seems I’ve been mentioning the budget a lot in this article, it’s because I have, and with good reason. The purpose of preparing the budget in the first place is to ensure that you don’t spend more than you make. Adhering to this single, basic principle is the financial strategy that will get you farther than any magic formulas you may find.

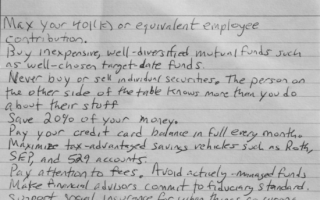

(Photo courtesy of j.o.h.n. walker)

Comments