Oh and one more update for this thread.

DON'T FORGET ABOUT BONDS!!!!

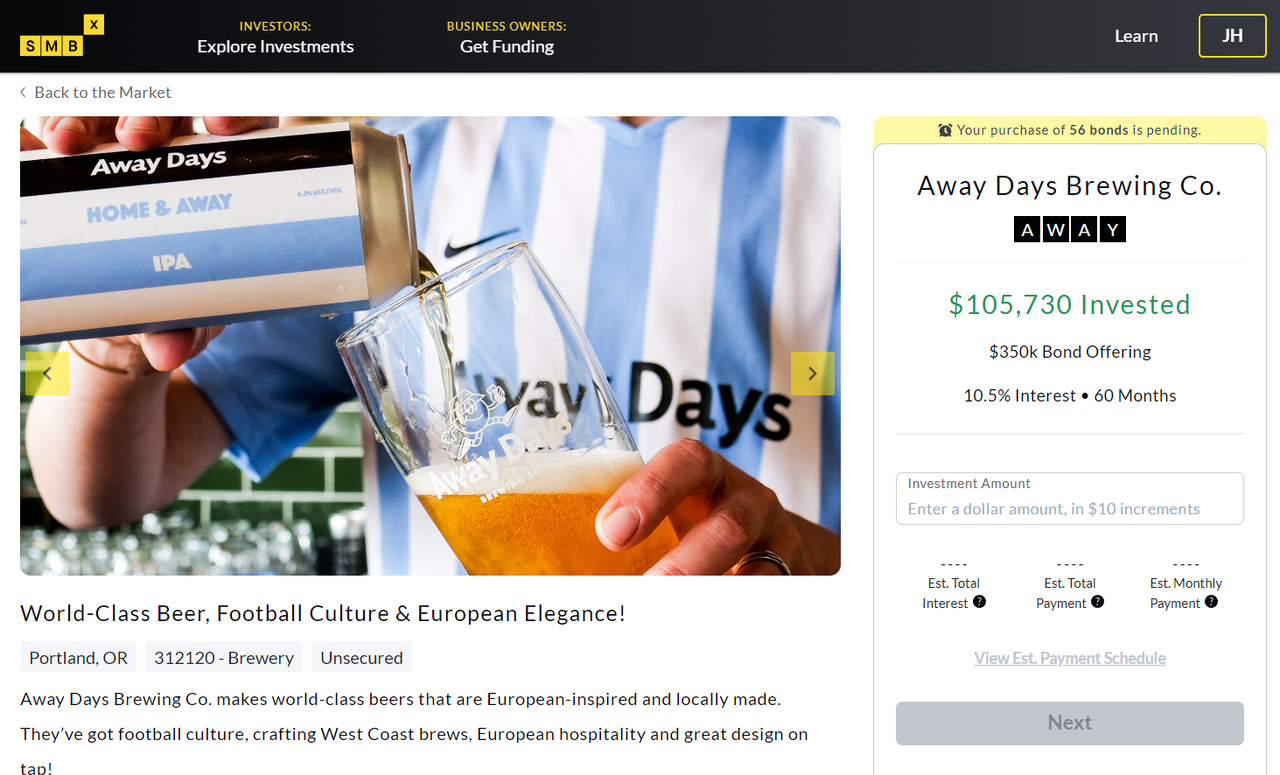

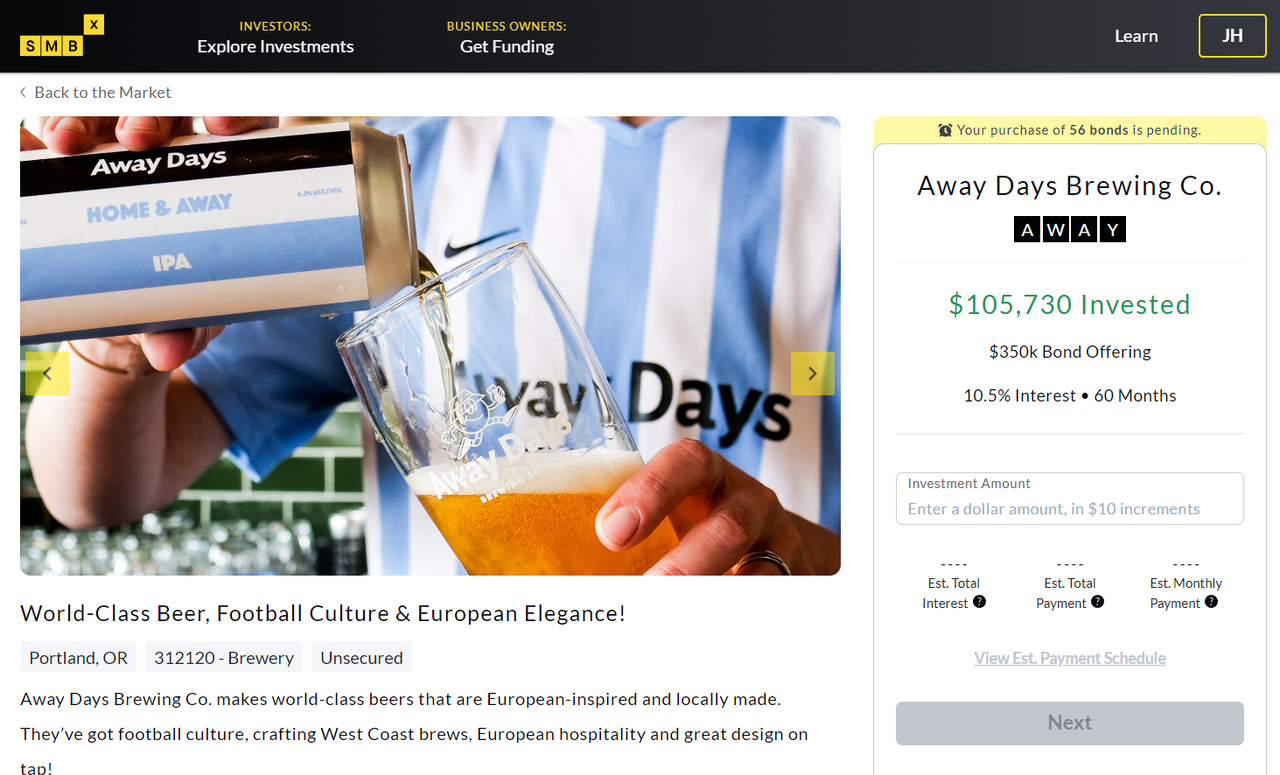

I've been investing in small business bonds through an app called The SMBX. SMBX stands for small business exchange. I regularly log into the site to reinvest my coupon payments.

I checked the app a few weeks ago and I saw that a brewery local to Portland, Oregon had a bond offering out to expand their locations. So, I went down the brewery and checked it out. The place was full, it was clean and it had customers. So, I put like $550 into the bond offering. Its enough to get some decent payments per month (given how the bonds are structured) and it was enough that I wouldn't loose any sleep if the brewery went under, so I pulled the trigger and placed the order.

So, the bottom line here is another classic way to make passive income is buy lending money/buying bonds. And this option has lots of flavors as indicated by the SMBX example here.

DON'T FORGET ABOUT BONDS!!!!

I've been investing in small business bonds through an app called The SMBX. SMBX stands for small business exchange. I regularly log into the site to reinvest my coupon payments.

I checked the app a few weeks ago and I saw that a brewery local to Portland, Oregon had a bond offering out to expand their locations. So, I went down the brewery and checked it out. The place was full, it was clean and it had customers. So, I put like $550 into the bond offering. Its enough to get some decent payments per month (given how the bonds are structured) and it was enough that I wouldn't loose any sleep if the brewery went under, so I pulled the trigger and placed the order.

So, the bottom line here is another classic way to make passive income is buy lending money/buying bonds. And this option has lots of flavors as indicated by the SMBX example here.

Comment