I know this totally a first world problem, but I'm struggling with a decision.

I am currently paying about twice my monthly mortgage payment and was planning on paying off my house next year in a lump sum (2 years left without the lump sum). If I switch to just the minimum monthly payment, it'll cost $2,500 more and take 5 years. I am highly considering that option for two reasons.

1. I can help fund a cabin my in-laws are restoring. If they have the funding fast enough, they can get it rent-able after memorial day next summer. If they don't, it gets ruined when the snow falls and it isn't ready (they get so much snow, kids get hired to shovel off roofs so they don't cave in!).

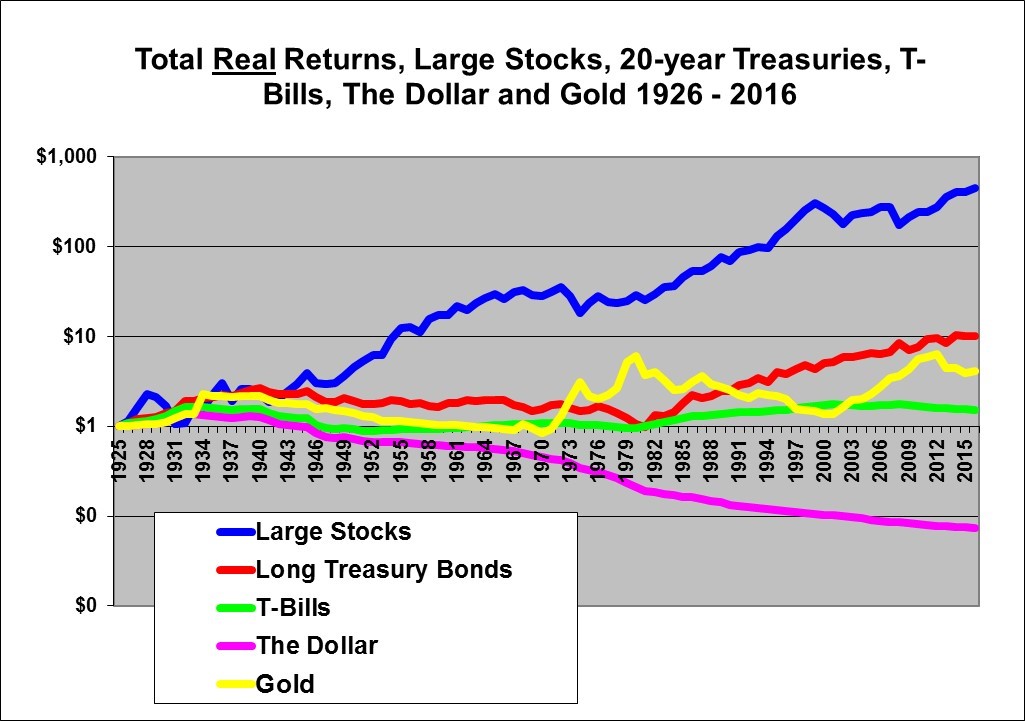

2. After the cabin is funded I might buy a gold coin every other month as I think it will appreciate more than whatever else I would do with the $2,500 I would save on interest.

If you think about it, $2,500 is a low premium to pay to spread out our remaining mortgage out over 5 years instead of 1.

Am I crazy? I could be debt free next year, but might throw away the opportunity.

Other information:

I believe in high inflation in the next 2-5 years. My household income will likely rise slower than inflation, but I think my husband will keep his job in even an extreme situation. Our mortgage is fixed rate. We are in our early 30's. We spend about 45% of our TAKE HOME household income on living, 10% on giving, 30% on investing (mostly additional principal on mortgage and occasional precious metals), and set aside 15% for big things that don't happen often (for example a new washing machine or water heater would be covered in our living expenses, but paying cash for a newish car would come out of savings).

I am currently paying about twice my monthly mortgage payment and was planning on paying off my house next year in a lump sum (2 years left without the lump sum). If I switch to just the minimum monthly payment, it'll cost $2,500 more and take 5 years. I am highly considering that option for two reasons.

1. I can help fund a cabin my in-laws are restoring. If they have the funding fast enough, they can get it rent-able after memorial day next summer. If they don't, it gets ruined when the snow falls and it isn't ready (they get so much snow, kids get hired to shovel off roofs so they don't cave in!).

2. After the cabin is funded I might buy a gold coin every other month as I think it will appreciate more than whatever else I would do with the $2,500 I would save on interest.

If you think about it, $2,500 is a low premium to pay to spread out our remaining mortgage out over 5 years instead of 1.

Am I crazy? I could be debt free next year, but might throw away the opportunity.

Other information:

I believe in high inflation in the next 2-5 years. My household income will likely rise slower than inflation, but I think my husband will keep his job in even an extreme situation. Our mortgage is fixed rate. We are in our early 30's. We spend about 45% of our TAKE HOME household income on living, 10% on giving, 30% on investing (mostly additional principal on mortgage and occasional precious metals), and set aside 15% for big things that don't happen often (for example a new washing machine or water heater would be covered in our living expenses, but paying cash for a newish car would come out of savings).

Comment