I've a friend who stared at me when I said we never carry credit card debt. Everyone carries a little bit of debt was the statement. I said no. Sometimes big repairs, medical bills, emergencies, etc. How do you not carry debt? We just don't.

Followed up with how did you get in the position of not carrying a little bit of debt? I say this because another says they don't have CC debt but they do carry a little that gets paid off every year with bonus checks. How do people manage without carrying a little here and there?

How do you manage without a car payment? When I suggested a 10 year plan that you maybe spend 10 years with the same car and then alternate between spouses/partners changing cars means you won't have more than 1 payment at a time every 5 years. Truth is not many people keep their cars 10 years.

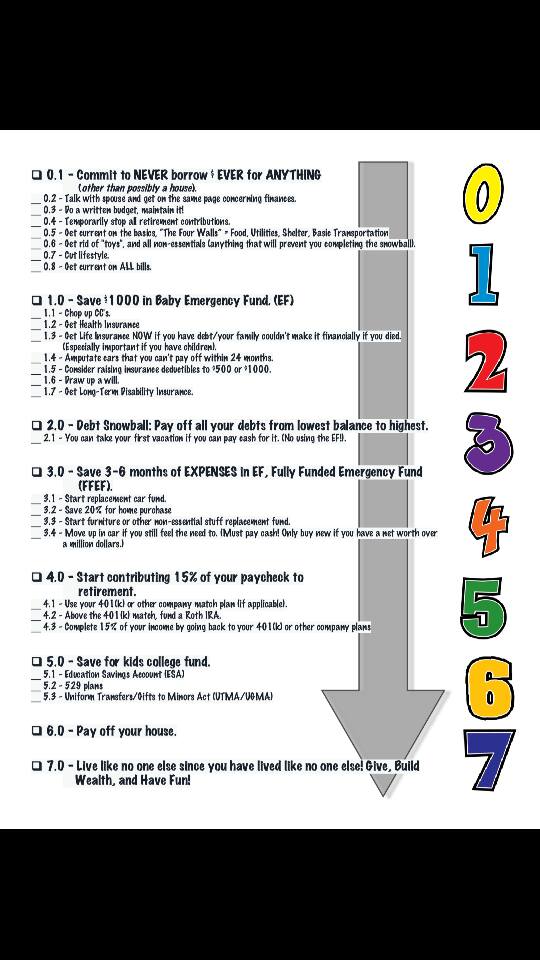

But honestly how do you tell people to stay out of CC debt? I mean if you are already there how do you get out? Trust me I pondered this a LONG time.

I mean if you start out from college without debt it's a lot easier. Make a budget, pay off school loans, live within your means. But if you start out always spending a little more than you make, it just sort of creeps up KWIM?

And then cutting back to spending what you make isn't enough. That's the real problem. When i suggested spending only cash the friends said it could work. But how do they pay off debt? I mean that's a cut in lifestyle already to cut up credit cards and pay cash.

I can see that. Say they were overspending by 10%. That's a 10% lifestyle reduction. But then to cut another 10% for debt reductions seems insane. Honestly 20% of lifestyle cut isn't easy.

Have you guys ever lived through cutting 20% or more of lifestyle to get out of debt? Any suggestions? I can only imagine how hard it is. I mean it's hard to cut 10%. How do you cut even more.

Followed up with how did you get in the position of not carrying a little bit of debt? I say this because another says they don't have CC debt but they do carry a little that gets paid off every year with bonus checks. How do people manage without carrying a little here and there?

How do you manage without a car payment? When I suggested a 10 year plan that you maybe spend 10 years with the same car and then alternate between spouses/partners changing cars means you won't have more than 1 payment at a time every 5 years. Truth is not many people keep their cars 10 years.

But honestly how do you tell people to stay out of CC debt? I mean if you are already there how do you get out? Trust me I pondered this a LONG time.

I mean if you start out from college without debt it's a lot easier. Make a budget, pay off school loans, live within your means. But if you start out always spending a little more than you make, it just sort of creeps up KWIM?

And then cutting back to spending what you make isn't enough. That's the real problem. When i suggested spending only cash the friends said it could work. But how do they pay off debt? I mean that's a cut in lifestyle already to cut up credit cards and pay cash.

I can see that. Say they were overspending by 10%. That's a 10% lifestyle reduction. But then to cut another 10% for debt reductions seems insane. Honestly 20% of lifestyle cut isn't easy.

Have you guys ever lived through cutting 20% or more of lifestyle to get out of debt? Any suggestions? I can only imagine how hard it is. I mean it's hard to cut 10%. How do you cut even more.

Comment