Here is an article the community might find interesting.

-------------------------------------------------------------------------

Americans Can’t Get Enough of the Stock Market

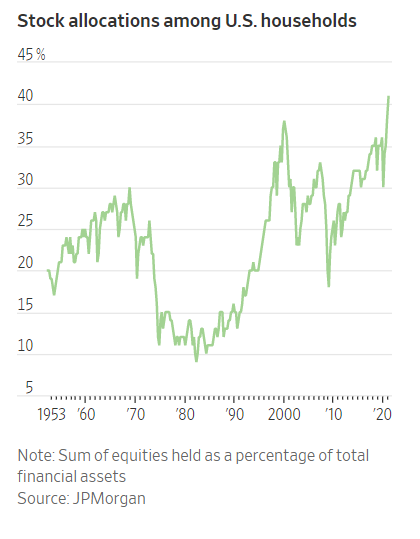

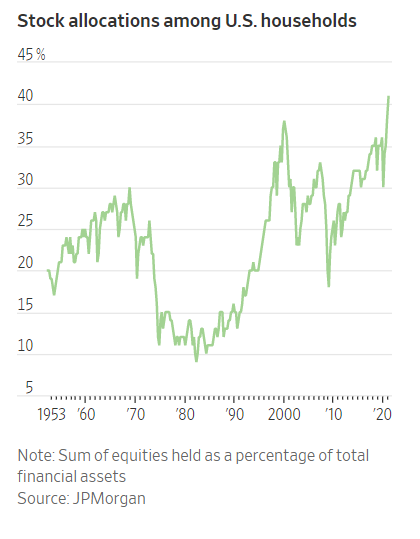

Households increased stockholdings to 41% of their total financial assets in April

Americans are all in on the stock market.

Individual investors are holding more stocks than ever before as major indexes climb to fresh highs. They are also upping the ante by borrowing to magnify their bets or increasingly buying on small dips in the market.

Stockholdings among U.S. households increased to 41% of their total financial assets in April, the highest level on record. That is according to JPMorgan Chase & Co. and Federal Reserve data going back to 1952 that includes 401(k) retirement accounts. JPMorgan’s Nikolaos Panigirtzoglou, who analyzed the data, attributes the elevated allocations to appreciating share prices alongside stock purchases.

The enthusiasm for stocks comes as market volatility has been edging lower and the S&P 500 has hit 25 records this year, fueled by a stellar earnings season and the prospect of an economic recovery that is speedier than many predicted. Meanwhile, stimulus checks have fueled a record rise in household incomes, boosting spending and helping propel the recovery.

In the coming week, the monthly jobs report and earnings results from companies like Uber Technologies Inc. will provide clues about the strength of the recovery.

Millions of new brokerage accounts were created during the Covid-19 pandemic and some investors who first tried their hands at stock or options trading over the past year have stuck around, adding to their investments. Financial advisers and money managers said their clients have grown more comfortable holding stocks as they witnessed the powerful rally over the past year, with some even questioning why they need bonds in their portfolios with yields still so low.

The steadily rising market—recently lifted by impressive earnings from companies like Facebook Inc. and Alphabet Inc. —has drawn even more investors in. Retail clients at Bank of America Corp. have bought stocks for nine consecutive weeks, while hedge funds and other big investors have recently fled the stock market, analysts at the bank said in an April 27 note.

Damon White, a 44-year-old physician assistant based in Sewell, N.J., said he started learning about stocks and options through social media platforms like TikTok while he was furloughed from his job last year.

Damon White has recently poured money into stocks like Tesla and American Airlines.

PHOTO: DAMON WHITE

He is back at work but says he still frequently checks in on his investments, recently pouring thousands more into the market, particularly in stocks like Apple, Tesla Inc. and American Airlines Group Inc., bringing his total stockholdings to more than $400,000.

“It was nerve-racking when you’re putting in a substantial amount of money,” Mr. White said. But, “if you have a quick finger, you’ll sell…and you’ll lose out in the long term.”

He doesn’t hold any bonds and plans to keep putting money into stocks.

Many individual investors haven’t been deterred by the market’s swoons. Data from research firm Vanda Research show that individual investors tend to buy more shares when the S&P 500 is down 1% on the day than when it is up by the same amount, and that their resolve to buy during selloffs has strengthened during the pandemic. Some have even borrowed to amplify their stock-market bets.

David Sadkin, a partner at Bel Air Investment Advisors who oversees $4.6 billion for wealthy clients, said the share of their money that is sitting in the stock market has increased to about 65% from roughly 45% last year, while he has whittled down investments in bonds. As his bondholdings mature, he has gradually reinvested the money into stocks.

The yield on the 10-year Treasury note settled at 1.632% Friday, up from around 0.915%, where it started the year, but still a low level historically.

“In order to achieve our clients’ goals, we need to take on more risk,” Mr. Sadkin said. “We intend to continue to reallocate into risk assets while interest rates stay this low.”

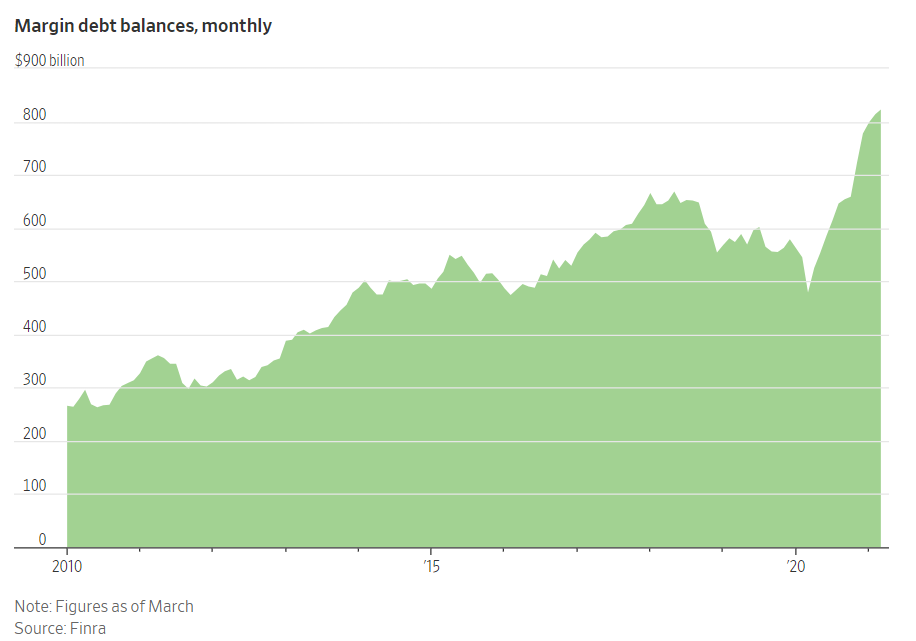

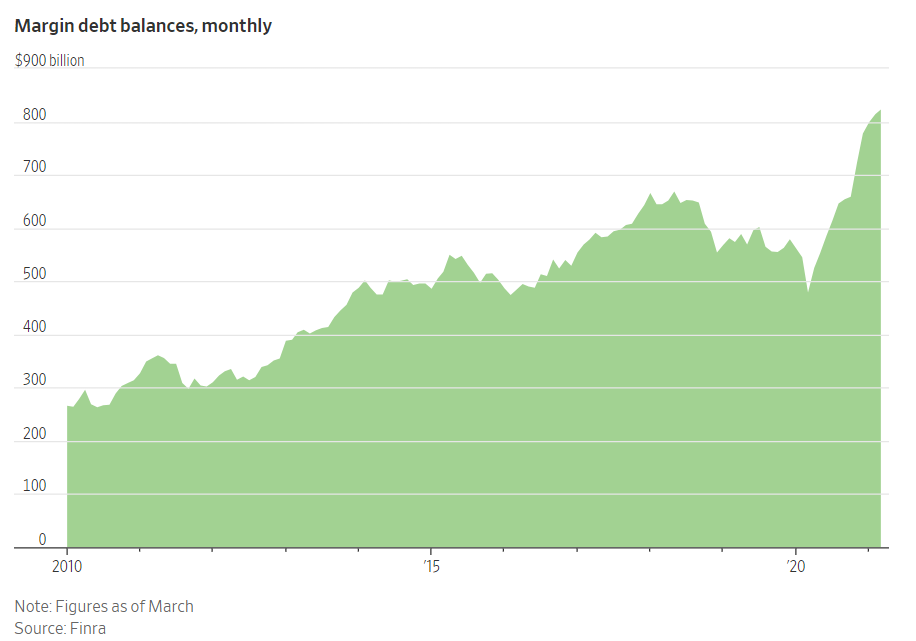

Other investors have been even more aggressive. A survey by the American Association of Individual Investors showed that investors’ allocations to the stock market hit around a three-year high of 70% in March. And margin debt—or money that investors borrow to buy securities— stood at a record as of March, Financial Industry Regulatory Authority figures show.

Randy Lee, a 31-year-old software engineer based in Lansing, Mich., said he was initially drawn to the quick thrills of options trading, witnessing his small investments roughly double or triple within hours.

Now, he says he still plays in the options market but also holds “boring” stocks like Royal Caribbean Group and Kraft Heinz Co.

Randy Lee says he doubled contributions to his retirement account.

PHOTO: RANDY LEE

Jolted by the uncertainty of the pandemic, he also started stashing away more money in his retirement account. He doubled his biweekly contributions to the account and opened a Roth IRA account, which he has added to in recent weeks. Most of his holdings are in the stock market.

“I just never had that much time to just sit at home and look at this stuff,” said Mr. Lee. “What better place to create money like everyone else than to start playing the stock market.”

He is optimistic about stocks, particularly after seeing the tech behemoths report record profits last week. But he does worry about a market crash in the future and has bought some cryptocurrencies, which he views as a hedge against a downturn.

He isn’t alone—the rising prices of everything from lumber to dogecoin to stocks has triggered worries about a market bubble. And to some analysts, the exuberance surrounding the stock market is flashing a warning sign.

“Retail investors have made a lot of money on many things including equities over the past year. At some point, given how high their equity allocation is, the risk is they decide to get out and take profits,” said Mr. Panigirtzoglou, a managing director at JPMorgan. “That is effectively what happened before in 2000.”

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

Source: Wall Street Journal.

-------------------------------------------------------------------------

Americans Can’t Get Enough of the Stock Market

Households increased stockholdings to 41% of their total financial assets in April

Americans are all in on the stock market.

Individual investors are holding more stocks than ever before as major indexes climb to fresh highs. They are also upping the ante by borrowing to magnify their bets or increasingly buying on small dips in the market.

Stockholdings among U.S. households increased to 41% of their total financial assets in April, the highest level on record. That is according to JPMorgan Chase & Co. and Federal Reserve data going back to 1952 that includes 401(k) retirement accounts. JPMorgan’s Nikolaos Panigirtzoglou, who analyzed the data, attributes the elevated allocations to appreciating share prices alongside stock purchases.

The enthusiasm for stocks comes as market volatility has been edging lower and the S&P 500 has hit 25 records this year, fueled by a stellar earnings season and the prospect of an economic recovery that is speedier than many predicted. Meanwhile, stimulus checks have fueled a record rise in household incomes, boosting spending and helping propel the recovery.

In the coming week, the monthly jobs report and earnings results from companies like Uber Technologies Inc. will provide clues about the strength of the recovery.

Millions of new brokerage accounts were created during the Covid-19 pandemic and some investors who first tried their hands at stock or options trading over the past year have stuck around, adding to their investments. Financial advisers and money managers said their clients have grown more comfortable holding stocks as they witnessed the powerful rally over the past year, with some even questioning why they need bonds in their portfolios with yields still so low.

The steadily rising market—recently lifted by impressive earnings from companies like Facebook Inc. and Alphabet Inc. —has drawn even more investors in. Retail clients at Bank of America Corp. have bought stocks for nine consecutive weeks, while hedge funds and other big investors have recently fled the stock market, analysts at the bank said in an April 27 note.

Damon White, a 44-year-old physician assistant based in Sewell, N.J., said he started learning about stocks and options through social media platforms like TikTok while he was furloughed from his job last year.

Damon White has recently poured money into stocks like Tesla and American Airlines.

PHOTO: DAMON WHITE

He is back at work but says he still frequently checks in on his investments, recently pouring thousands more into the market, particularly in stocks like Apple, Tesla Inc. and American Airlines Group Inc., bringing his total stockholdings to more than $400,000.

“It was nerve-racking when you’re putting in a substantial amount of money,” Mr. White said. But, “if you have a quick finger, you’ll sell…and you’ll lose out in the long term.”

He doesn’t hold any bonds and plans to keep putting money into stocks.

Many individual investors haven’t been deterred by the market’s swoons. Data from research firm Vanda Research show that individual investors tend to buy more shares when the S&P 500 is down 1% on the day than when it is up by the same amount, and that their resolve to buy during selloffs has strengthened during the pandemic. Some have even borrowed to amplify their stock-market bets.

David Sadkin, a partner at Bel Air Investment Advisors who oversees $4.6 billion for wealthy clients, said the share of their money that is sitting in the stock market has increased to about 65% from roughly 45% last year, while he has whittled down investments in bonds. As his bondholdings mature, he has gradually reinvested the money into stocks.

The yield on the 10-year Treasury note settled at 1.632% Friday, up from around 0.915%, where it started the year, but still a low level historically.

“In order to achieve our clients’ goals, we need to take on more risk,” Mr. Sadkin said. “We intend to continue to reallocate into risk assets while interest rates stay this low.”

Other investors have been even more aggressive. A survey by the American Association of Individual Investors showed that investors’ allocations to the stock market hit around a three-year high of 70% in March. And margin debt—or money that investors borrow to buy securities— stood at a record as of March, Financial Industry Regulatory Authority figures show.

Randy Lee, a 31-year-old software engineer based in Lansing, Mich., said he was initially drawn to the quick thrills of options trading, witnessing his small investments roughly double or triple within hours.

Now, he says he still plays in the options market but also holds “boring” stocks like Royal Caribbean Group and Kraft Heinz Co.

Randy Lee says he doubled contributions to his retirement account.

PHOTO: RANDY LEE

Jolted by the uncertainty of the pandemic, he also started stashing away more money in his retirement account. He doubled his biweekly contributions to the account and opened a Roth IRA account, which he has added to in recent weeks. Most of his holdings are in the stock market.

“I just never had that much time to just sit at home and look at this stuff,” said Mr. Lee. “What better place to create money like everyone else than to start playing the stock market.”

He is optimistic about stocks, particularly after seeing the tech behemoths report record profits last week. But he does worry about a market crash in the future and has bought some cryptocurrencies, which he views as a hedge against a downturn.

He isn’t alone—the rising prices of everything from lumber to dogecoin to stocks has triggered worries about a market bubble. And to some analysts, the exuberance surrounding the stock market is flashing a warning sign.

“Retail investors have made a lot of money on many things including equities over the past year. At some point, given how high their equity allocation is, the risk is they decide to get out and take profits,” said Mr. Panigirtzoglou, a managing director at JPMorgan. “That is effectively what happened before in 2000.”

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

Source: Wall Street Journal.

.

.

Comment