This is making the rounds on the web, so I wanted to share it here.

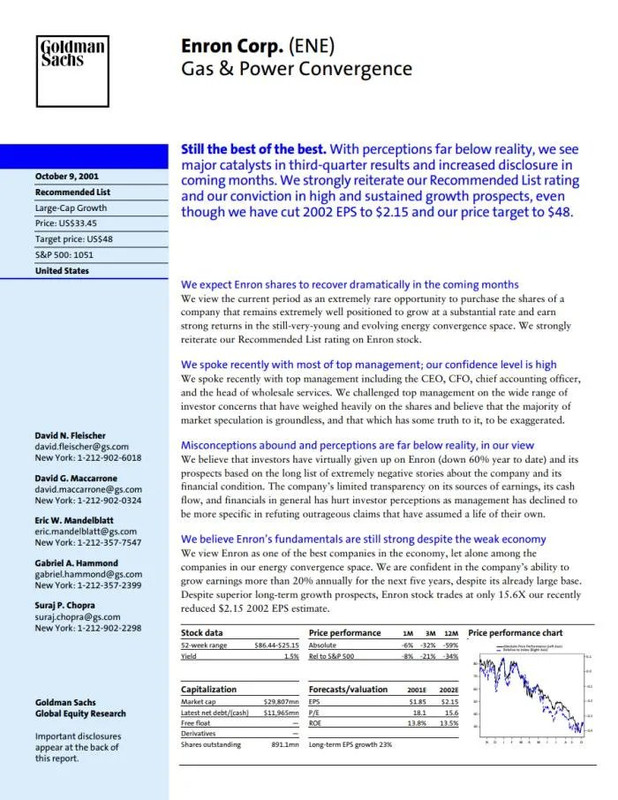

Its a Goldman Sachs report on Enron. The report says Enron was still "best of the best". Its a nice example that sometimes the smart money can be very wrong some of the time.

For the younger or non-US members on the forums, at the beginning of 2001, it came out that Enron's financial condition was sustained by institutionalized, systematic, and creatively planned accounting fraud. Enron has since become synonymous with willful corporate fraud and corruption. The Enron situation also raised serious and long term questions about US corporate accounting practices and was a factor in the Sarbanes-Oxley act of 2002. The scandal also lead to the dissolution of Arthur-Anderson, the accounting firm which audited Enron's books.

Its a Goldman Sachs report on Enron. The report says Enron was still "best of the best". Its a nice example that sometimes the smart money can be very wrong some of the time.

For the younger or non-US members on the forums, at the beginning of 2001, it came out that Enron's financial condition was sustained by institutionalized, systematic, and creatively planned accounting fraud. Enron has since become synonymous with willful corporate fraud and corruption. The Enron situation also raised serious and long term questions about US corporate accounting practices and was a factor in the Sarbanes-Oxley act of 2002. The scandal also lead to the dissolution of Arthur-Anderson, the accounting firm which audited Enron's books.

Comment