Hello!

Just curious on everyone's thoughts on Dave Ramsey overall? Personally, there are some things I agree with and others that I do not....

- 12% rate of return - Dave bases all of his investing advice/projections on this number. Seems unrealistic to me for many reasons.

- No credit cards - Dave preaches don't ever have a credit card. Claims all you need is a debit card. I'm not sure I agree with this. A credit card, paid in full every month that it's used can provide you things such as rewards/points and flexibility with your cash flow.

- No Debt - This part I agree with. It's great to not have debt (I'm almost there except for my house), although a little debt here or there doesn't stress me out too much.

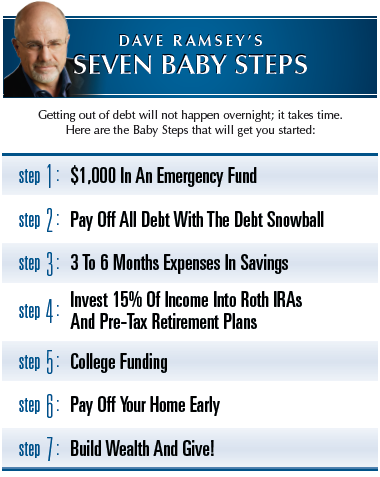

- Baby Steps - Dave is always touting the baby steps as the way to get out of debt and be smarter with your money. I agree with most of them, although I DO NOT agree with draining your E-Fund to 1k to pay down debt. Maybe it's just me, but that seems like a recipe for disaster!

What do you think on the items I listed above?

Just curious on everyone's thoughts on Dave Ramsey overall? Personally, there are some things I agree with and others that I do not....

- 12% rate of return - Dave bases all of his investing advice/projections on this number. Seems unrealistic to me for many reasons.

- No credit cards - Dave preaches don't ever have a credit card. Claims all you need is a debit card. I'm not sure I agree with this. A credit card, paid in full every month that it's used can provide you things such as rewards/points and flexibility with your cash flow.

- No Debt - This part I agree with. It's great to not have debt (I'm almost there except for my house), although a little debt here or there doesn't stress me out too much.

- Baby Steps - Dave is always touting the baby steps as the way to get out of debt and be smarter with your money. I agree with most of them, although I DO NOT agree with draining your E-Fund to 1k to pay down debt. Maybe it's just me, but that seems like a recipe for disaster!

What do you think on the items I listed above?

Comment