Understanding the impact of interest rates on bonds is a core part of financial literacy. In fact, there is really only one or two rules to follow for bonds. When the market rate of interest on bonds is higher than the contract rate, the bonds will sell at a discount. The opposite is also true, when market rates of interest on bonds are lower than the contract rate, bonds will sell at a premium.

What Are Bonds

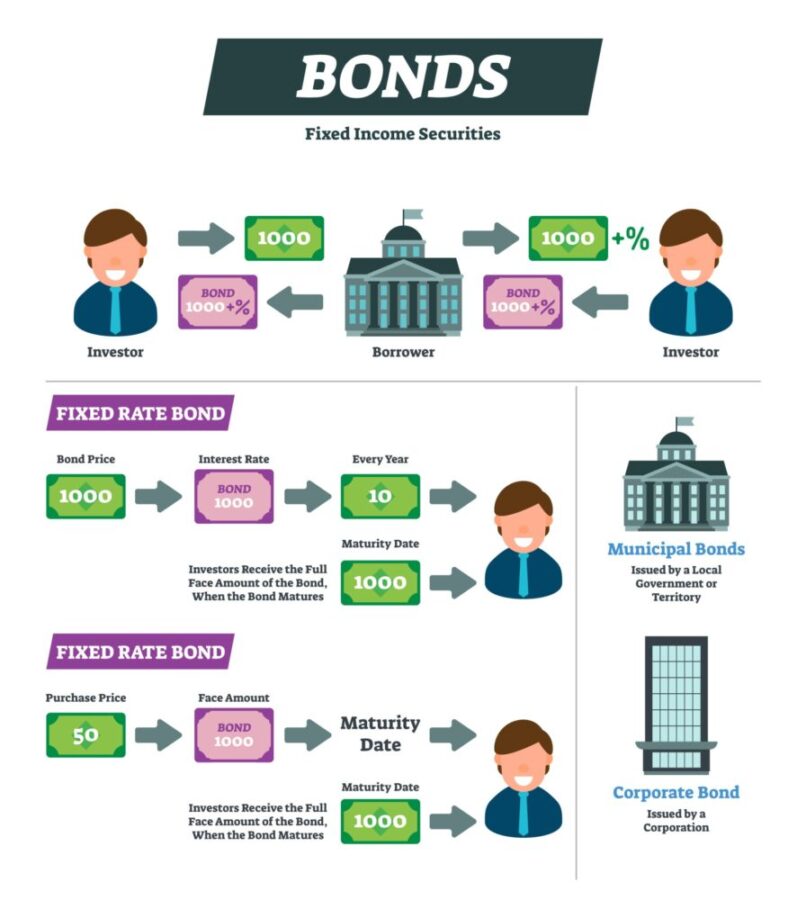

A bond is a debt investment in which an investor loans money to an entity for a defined period of time at a fixed interest rate. The entity then pays the investor periodic interest payments over the life of the loan, and repays the principal amount of the loan at maturity. bonds can be issued by corporations, municipalities, states, and sovereign governments—although the most common type are corporate bonds. When an investor buys a bond, they are effectively lending money to the issuer. In return, the issuer promises to make regular interest payments to the investor, as well as repay the principal amount of the loan when it matures. Although bonds typically have a lower potential return than stocks, they also tend to be less risky. As a result, investors often use bonds to provide stability and income in their portfolios.

How Do Interest Rates Impact Bonds?

The relationship between bonds and interest rates is determined by current market conditions. When interest rates are low, bonds are more likely to be in demand because they offer a higher rate of return. As a result, bonds tend to sell at a premium, or above their face value.

On the other hand, when interest rates are high, bonds are less attractive to investors and tend to sell at a discount, or below their face value. The yield on a bond is directly related to its price; as the price of a bond goes up, the yield goes down, and vice versa. Therefore, when interest rates rise, the prices of bonds fall, and when interest rates fall, the prices of bonds rise.

So, there you have it: When the market rate of interest on bonds is higher than the contract rate, the bonds will sell at a discount.