Knowing When to Use a Flat Fee Per Trade or Fee Per Share

A common question that frequently arises during the creation of an investment strategy is “when I choose my plan for trading fees, should I opt for a flat fee per trade or a fee per share”? The simple answer is that it depends on how much volume you are trading in.

A flat fee involves paying a single rate regardless of how many shares are purchased while a ‘fee per share’ involves what the name says: Paying a price for each share that is traded.

If you are trading in a large volume, you should go with a flat fee structure. If you are trading in small volume, then you are better off paying a fee per share.

Trading through Discount Brokerages (Drivewealth, Questrade)

In stock trading, fees comparison is crucial to finding the right stockbroker or firm to work with. Unlike a full-service broker, a discount broker will carry out your buy and sell orders at a lower commission price. The only drawback to this is that you will not receive any investment advice from them.

Two discount brokerages that come well-recommended are Drivewealth and Questrade. With easy-to-use trading platforms on multiple devices and a great reputation from many years of successful service, you can feel safe knowing that your money is in good hands.

Buying Mutual Funds

Mutual funds are one of the low-risk options that people use when they want to create an investment portfolio with the cheapest trade fees possible. One of the great things about mutual funds is that you can pool money with other people and have all of it managed by a fund manager. There are NO trading fees!

However, there is a management expense that you will have to pay. As mentioned in the beginning, there might be hidden fees that you will have to watch out for when choosing to have your money managed by someone else. Read the fine print and make sure you know what you are getting into before signing on the dotted line.

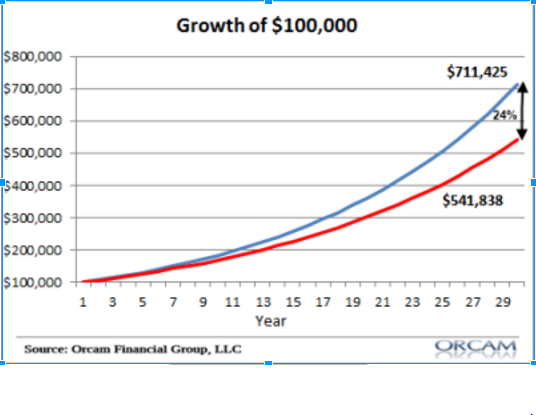

While trading fees may seem like very minimal monetary sums, over the long-term, they can significantly impact profits and therefore it is crucial not to ignore them. There is nothing wrong with looking for the cheapest trading fees to save money when you are buying stocks. At the same time, it is important to not make the mistake of overthinking this because you will have to pay a fee once you settle on some stocks and a firm or manager to manage your portfolio (should you choose that option). All you are doing is finding a fee structure that will have the most minimal effect on your profits.

Photo: Flickr: OTA Photos

Comments