Hello all,

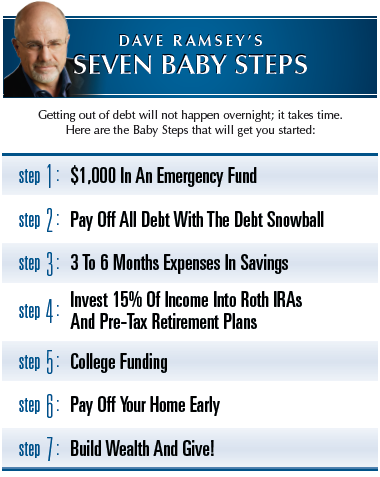

I am new here so i will give a little bit of an introduction. I am a 23 year old recent college graduate in Construction Management. I have been with my girlfriend for 4 years, and now we have bought a house. I have never been good at budgeting and i had over 10k of credit card debt by 21. So i found this forum and with inspiration from Dave Ramsey and other authors I am ready to change this around. I have paid total credit card debt down to just under 6k in this last year while still being in school.

So i am trying to get advice on how to pay this down, and some insight on my budget.

Income (Take home)

Me: $3200

Her: $2000

Debts

Capital One: $2800

PayPal: $1800

Amazon: $1200

Student Loan: $27000

Home: $176000 w/ a payment of $1020 with PMI, and Escrow

Monthly Budget is as follows

Transportation

Insurance: $119/Month w/ both vehicles

Gas: $320/Month

Taxes: $33/Month

Maintenance: $50/Month

Home

Mortgage: $1020/Month

Insurance: $57/Month

Maintenance: $115/Month (Future Costs - Roof, Water heater, ect.)

Household Items: $60/Month (Furniture, upgrades)

Utilities (Subject to change as we have not moved in so we dont know actual amounts)

Phone/Cell: $100/Month

Internet: $80/Month

Water: $120/Month

Electricity: $250/Month

Trash: $40/Month

Entertainment

Spotify: $5/Month

Gym: $30/Month

Events Allowance: $50/Month

Hobbies Allowance: $100/Month (Pays for my woodworking and car hobbies)

Travel/Vacation Allowance: $100/Month (Savings for a vacation)

Dining

Dining Out: $120/Month

Fast food: $60/Month (Lunches on fridays with my crew)

Groceries: $500/Month

Misc.

Retirement Accounts: $750/Month (Neither of our companies contribute, so we need some opinions here)

Clothing Allowance: $60/Month

Pocket Money: $240/Month

Gift Allowance: $100/Month (Christmas, Birthdays, Ect.)

Debts

Capital One: $80/Month

Amazon: $80/Month

PayPal: $80/Month

Student Loan: $490 (Payment plan calls for $300)

My plan right now halt the following items: Student Loan (Defer for 6 Months), Gifts, Clothing, Hobbies, Travel, Events, and retirement combined $1650 snowball on to my credit card debts. This would make a total of $1890 to credit card debts per month and I would have it paid off in 3 months. After the three months i'd budget back in the allowances and focus on my student loan debt with the $490+$240 from credit cards minimum payments to have it paid off in just over 3 years. After that over id like to focus the extra money onto the mortgage principle.

Any help or advice would be awesome!

I am new here so i will give a little bit of an introduction. I am a 23 year old recent college graduate in Construction Management. I have been with my girlfriend for 4 years, and now we have bought a house. I have never been good at budgeting and i had over 10k of credit card debt by 21. So i found this forum and with inspiration from Dave Ramsey and other authors I am ready to change this around. I have paid total credit card debt down to just under 6k in this last year while still being in school.

So i am trying to get advice on how to pay this down, and some insight on my budget.

Income (Take home)

Me: $3200

Her: $2000

Debts

Capital One: $2800

PayPal: $1800

Amazon: $1200

Student Loan: $27000

Home: $176000 w/ a payment of $1020 with PMI, and Escrow

Monthly Budget is as follows

Transportation

Insurance: $119/Month w/ both vehicles

Gas: $320/Month

Taxes: $33/Month

Maintenance: $50/Month

Home

Mortgage: $1020/Month

Insurance: $57/Month

Maintenance: $115/Month (Future Costs - Roof, Water heater, ect.)

Household Items: $60/Month (Furniture, upgrades)

Utilities (Subject to change as we have not moved in so we dont know actual amounts)

Phone/Cell: $100/Month

Internet: $80/Month

Water: $120/Month

Electricity: $250/Month

Trash: $40/Month

Entertainment

Spotify: $5/Month

Gym: $30/Month

Events Allowance: $50/Month

Hobbies Allowance: $100/Month (Pays for my woodworking and car hobbies)

Travel/Vacation Allowance: $100/Month (Savings for a vacation)

Dining

Dining Out: $120/Month

Fast food: $60/Month (Lunches on fridays with my crew)

Groceries: $500/Month

Misc.

Retirement Accounts: $750/Month (Neither of our companies contribute, so we need some opinions here)

Clothing Allowance: $60/Month

Pocket Money: $240/Month

Gift Allowance: $100/Month (Christmas, Birthdays, Ect.)

Debts

Capital One: $80/Month

Amazon: $80/Month

PayPal: $80/Month

Student Loan: $490 (Payment plan calls for $300)

My plan right now halt the following items: Student Loan (Defer for 6 Months), Gifts, Clothing, Hobbies, Travel, Events, and retirement combined $1650 snowball on to my credit card debts. This would make a total of $1890 to credit card debts per month and I would have it paid off in 3 months. After the three months i'd budget back in the allowances and focus on my student loan debt with the $490+$240 from credit cards minimum payments to have it paid off in just over 3 years. After that over id like to focus the extra money onto the mortgage principle.

Any help or advice would be awesome!

.

.

Comment