The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing

A group of younger workers, devotees of the FIRE movement, are seeking ways to duck mistakes made by prior generations

The Wall Street Journal

Nov 3, 2018

Sylvia Hall, a 38-year-old lawyer in Seattle, plans to retire in two years. PHOTO: Matt Luton for The Wall Street Journal

Sylvia Hall wants to retire at age 40. Her dream has a price: brown bananas.

The 38-year-old Seattle lawyer is on a strict budget as she tries to hit her goal of amassing $2 million in assets by 2020. That means saving about 70% of her after-tax income and setting firm spending limits in every part of her life.

She looks for brown bananas and other soon-to-be discarded items from fruit and vegetable stands to help keep her grocery bills around $75 a month. She walks to work so she doesn’t have to spend money on gas. She borrows Netflix passwords from friends so she doesn’t have to spend much on entertainment.

“

The idea of not having to wait to 65 to start living on my own terms appealed to me,” she said.

For a new generation of Americans, the traditional retirement age of 65 is getting old. Some of the youngest members of the U.S. workforce are saving aggressively and spending little so they can leave work decades ahead of schedule, defying the career arc that typically defines adult life.

Their reasons for flouting conventional career norms and saving at high rates range from dissatisfaction with unfulfilling work to the decline of traditional social safety nets to a desire for more economic security in an era defined by events such as the 2008 financial crisis.

Even though they are better educated than their parents and grandparents, people between 25 and 35 have less wealth than prior recent generations, and “are behind in almost every economic dimension,” said Alicia Munnell, director of the Boston College Center for Retirement Research, including earnings and debt.

Ms. Hall’s apartment is 400 square feet. PHOTO: Matt Lutton for The Wall Street Journal

They’re also watching the generation entering retirement struggle with many of the same problems. About 10,000 people turn 65 every day and many are unprepared for the years ahead. Older Americans have high average debt. Their 401(k)-type retirement funds will bring in a median income of under $8,000 a year for a 65-year-old couple.

The younger generation’s radical solution—dubbed Financial Independence, Retire Early—has spawned an ecosystem of podcasts, blogs, books, conferences and informal discussion groups. One online forum dedicated to the concept, known to its followers by the acronym “FIRE,” has more than 450,000 subscribers.

FIRE adherents are often millennials and younger members of Generation X who have college degrees, above-average incomes and the discipline to adopt a strict do-it-yourself approach to retirement. Some say they are saving as much as three-quarters of their income, or five times the 15% savings rate conventional financial advisers often recommend, and growing their own food. Others are taking more modest measures such as living in smaller houses and driving older cars.

“

It gives people more control over their lives and time,” said Grant Sabatier, 33, who writes a blog about the topic called Millennial Money. “We live in uncertain times and financial empowerment provides a path out.”

The downside of FIRE is its inherent paradox: For those seeking financial security, early retirement can be risky. Since many early retirees rely solely on income from stocks, bonds or real estate for living expenses, sudden market downturns can pose a threat to their plans. At the same time, these people have to forecast their cost of living for decades. This means prolonged periods of high inflation can wreck their forecasts and budgets.

The self-reliance and thrift embodied by FIRE have roots in American history. Elements of the philosophy can be found in Ben Franklin’s 1758 classic “The Way to Wealth,” Ralph Waldo Emerson’s 1841 essay “Self-Reliance” and Henry David Thoreau’s “Walden,” an 1854 book about living simply in a cabin he built near Concord, Mass.

Many FIRE boosters cite a more recent work: the 1992 book “Your Money or Your Life” by Vicki Robin and Joe Dominguez. This paean to financial independence and anti-consumerism, a business best seller in the ‘90s, found a new audience after the 2008 financial crisis.

“

Millennials understand the rules have changed,” said Ms. Robin, now 73. “They understand that the system their parents built is coming apart.”

FIRE enthusiasts gather around the country to discuss ways to save more, spend less, and manage investments. A recent meet-up in Manhattan attracted close to 30 people to an office conference room. The attendees—mostly men in their 20s and 30s, several with backgrounds in engineering—discussed taxes, index funds and real-estate investing over beer and potato chips.

“

We are surrounded by consumerism, advertisements and marketing, and there are a lot of easy ways to spend,” said David Rodriguez, 33, a mechanical engineer who helped organize the meeting. “It is important to have a place to find like-minded people.”

The interest in thrift is flourishing most visibly online where frugality evangelists amass large followings via podcasts, blogs and conferences. One of the most popular FIRE blogs, Mr. Money Mustache, started in 2011, has attracted about 2.5 million page views in the past 30 days, according to Google Analytics data. A podcast devoted to the topic, ChooseFI, has been downloaded 5.2 million times and been played in 190 countries since its inception in early 2017, according to podcast hosting service Liberated Syndication. This puts it in the top 2% of the more than 50,000 podcasts the service hosts.

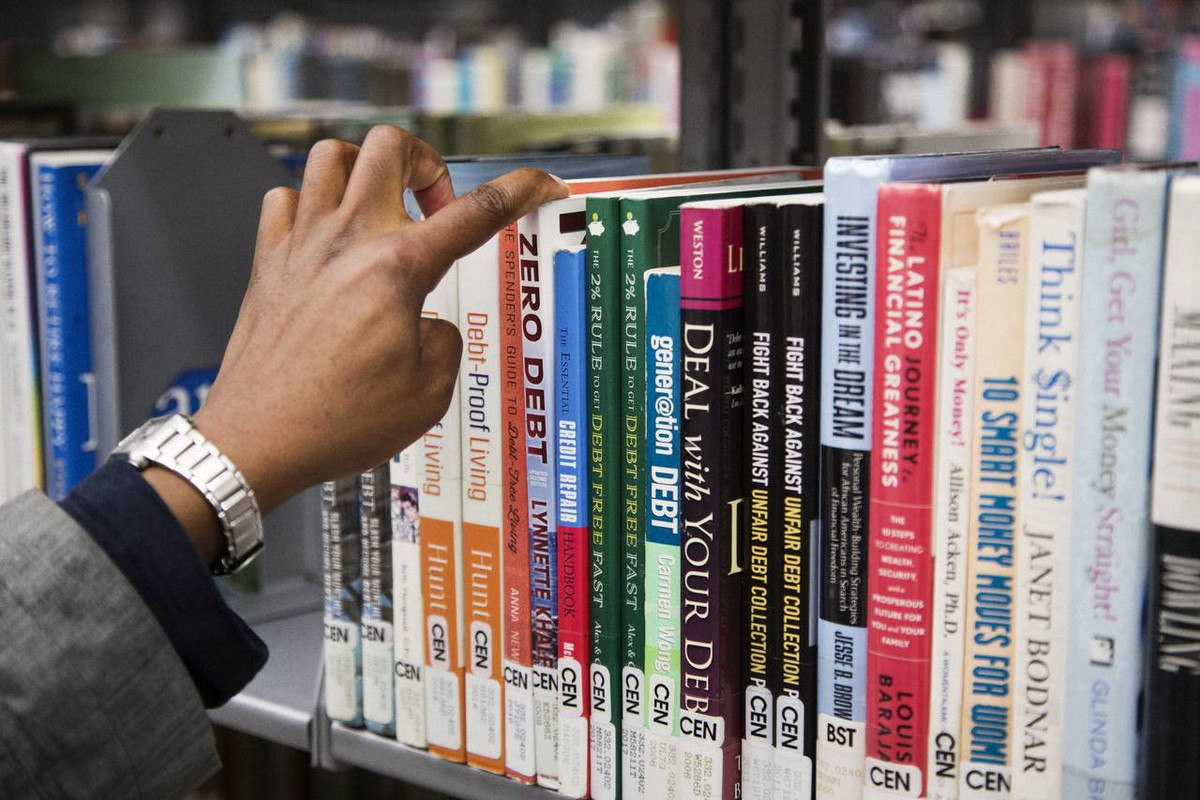

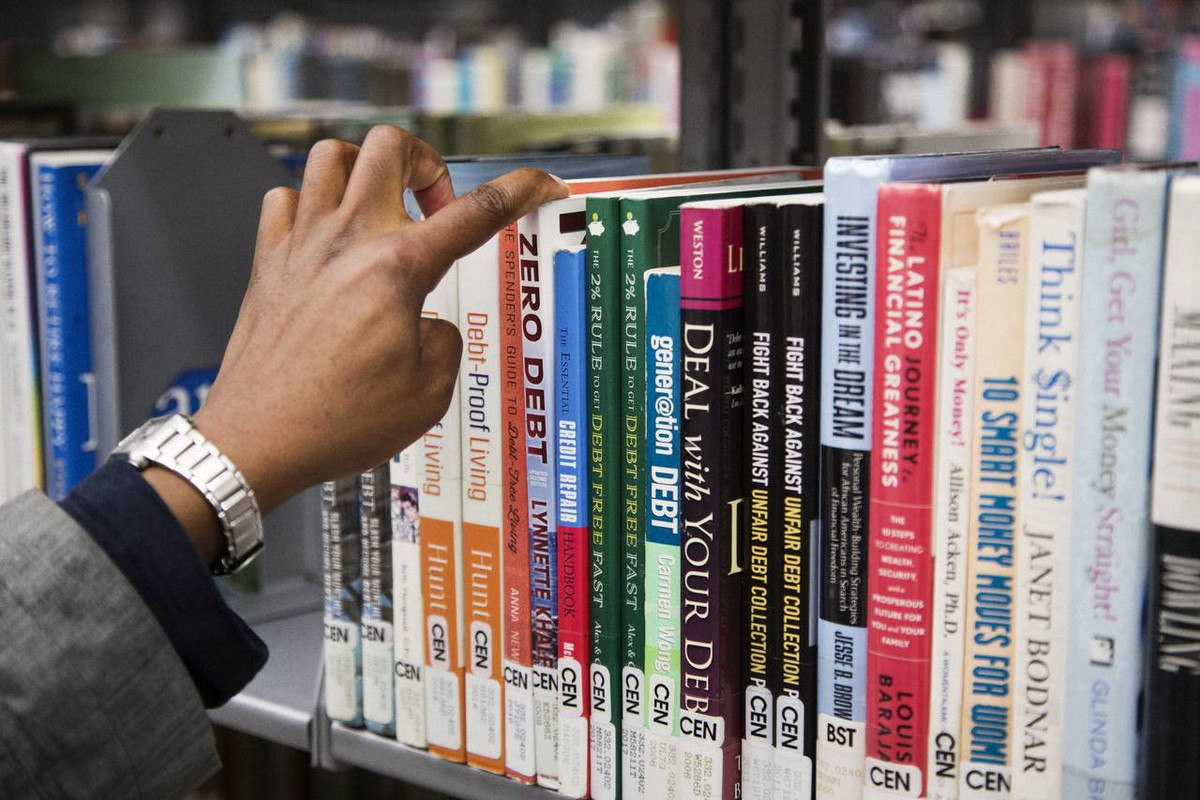

Ms. Hall visits the library for books and videos; she borrows Netflix logins from friends. PHOTO: Matt Lutton for The Wall Street Journal

Attendees at “FI Chautauqua,” a week-long financial independence conference, spent up to $3,000 this year (not including airfare) to go to Greece and hear leaders in the FIRE community share tips.

Some who have tried the path of early retirement say it isn’t always as idyllic as it sounds. Socializing with people who still have conventional jobs can be awkward, said Ed Ditto, 49, who retired at 36 as an energy trader and now writes the Early Retirement Dude blog. His solution is to invite friends and neighbors to backyard potlucks.

“I don’t bring up the fact that I don’t have a job,” he said. “If someone is interested, I’ll talk about it, but I don’t want to run the risk of stirring up resentment.”

Brandon Ganch, 36, who retired from his job as a software engineer in 2016, said his frugality became an obsession and he stressed over small purchases by his wife. He often got upset when visitors took long hot showers at his former Vermont home or his wife ordered a “$15 main course instead of a $10 sandwich” at a restaurant.

It wasn’t healthy,” said Mr. Ganch, who now lives in Scotland.

“

Frugalwoods” author Elizabeth Thames quit her nonprofit job so she could concentrate on a blog about life as a rural Vermont homesteader, a dream made possible by “extreme frugality” her website says. It says she has found “everything from coats to fondue pots to wine glasses” in the trash and that her husband learned to fix the plumbing.

One complaint from readers was that the 33-year-old author and her husband still earn sizable incomes. Nate Thames works for a nonprofit and was paid about $270,000 in 2016, according to his employer’s most recent tax forms. Ms. Thames makes an undisclosed amount from her blog and a recently published book.

“Now I understand why even with cutting everything to the bone, that we haven’t been able to save like they do,” a reader posted in an online review of the book.

Ms. Thames says she is “transparent about the fact that my husband still works a conventional job from home and that I enjoy working for myself through Frugalwoods.com.”

Mr. Sabatier, 33, says his Millennial Money website made $401,000 last year. Blogger Joe Udo, 44, recently disclosed he has made almost $350,000 since starting “Retire by 40” in 2010.

Tanja Hester, author of a blog called Our Next Life, called for FIRE bloggers to be more transparent about their financial lives in a post this year. She said she makes less than $1,000 a year on the blog, but declines to disclose her income from a book advance, saying “there’s no need to share your actual numbers if you are honest with readers about your general financial situation.”

Emma Pattee, 28, discovered she missed the social benefits of office life. She left a job in marketing two years ago with the goal of writing a novel. She had $150,000 in savings and more than $900,000 in real-estate equity, stemming from a $144,000 home she purchased in Portland, Ore., in 2012 that she says tripled in value, enabling her to purchase four other rental properties. Ms. Pattee, who married in 2015, says she and her husband, Andrew Hanna, 33, live off the rental income and save his salary in medical administration.

“It was hard to go from working every day in an office full of people to sitting in a tiny apartment by myself,” she said. “It is very isolating.”

Recently she began taking on more freelance work as a copywriter. “I got a lot more meaning from my work than I had realized,” she said. “It is a lot harder to find meaning than to save 70% of your income.”

Ms. Hall, the lawyer from Seattle, is hoping to retire with $2 million in assets at age 40. She currently has $1.5 million in assets and expects to hit her goal by 2020. Her plan then is to “Airbnb-it around the world” for 10 months on a retirement income of about $25,000 and visit friends and family the other two months.

She said she is aware of the problems that could trip her up, from unexpected health expenses to a prolonged bear market. But she said she has a detailed plan to secure health insurance abroad and if a market downturn dents her nest egg, she is confident she can adjust her lifestyle.The goal is to try to live in such a way that I won’t be forced to go back to work.”

FIRE proponents say they account for the danger of fluctuating markets by adhering to a rule-of-thumb pioneered by financial planner William Bengen, who concluded retirees should spend no more than 4.5% of their initial nest egg, adjusted annually for inflation, to ensure a high probability of supporting themselves over decades.

It isn’t quite that simple, Mr. Bengen, 71, said in an interview. Younger retirees are more vulnerable to unexpected expenses, and his rule applies only to tax-advantaged 401(k)s and individual retirement accounts for as long as 30 years.

It took a Category 5 catastrophe for Sylvia Hall to start thinking of changing her approach to her finances. When Hurricane Katrina struck the Gulf Coast in 2005, Ms. Hall, then a New Orleans resident, temporarily lost a home and a paycheck as the first payments were due on $101,600 in law-school debt.

The uncertainty was so unsettling Ms. Hall instituted a strict budget. She started buying discounted meat on its expiration date, took a second job delivering pizzas and began saving half of her $50,000 salary after her law firm reopened in 2006.

After setting aside about $250 a month for discretionary expenses, Ms. Hall devoted the rest—over $2,000 a month—to student loans. By 2009, she had paid off all but $35,000, which she consolidated at 1.6%.

“Not having anything freed me up to not be beholden to stuff and status and to be comfortable and happy with less,” Ms. Hall said. “There’s something liberating about that.”

Ms. Hall plans to have $2 million in assets when she retires. PHOTO: Matt Lutton for The Wall Street Journal

She stumbled on the Mr. Money Mustache blog in 2012, after moving to Seattle. The idea of retiring early resonated. She increased her savings to about 70% of her after-tax proceeds, which are now about $100,000, and limited her spending to no more than $30,000 annually. That includes $2,400 a year on car and homeowners’ insurance, $10,200 on mortgage payments and $75 a month on groceries.

Her grocery budget is so detailed she knows how much she will pay each month for oatmeal (a five-pound bag costs her $3), blueberries (a five-pound bag costs $10), popcorn (1 pound for $2) and rice (60 cents per pound). Now a vegan, she buys fruit at a stand that sells “a table of things that didn’t sell” at steep discounts, including brown bananas she freezes and uses for smoothies.

An occasional splurge is a $5 bottle of wine, or a box for $15.

Ms. Hall, who is single, frequently has friends over for potluck dinners, travels using rewards points on her credit cards, and buys season tickets to the theater for a price that works out to about $15 a month.

“I have always lived on very little but never felt I was being deprived,” she said. “If I made twice the money, I don’t think anything would change. There is nothing I want that I don’t have.”

Write to Anne Tergesen at anne.tergesen@wsj.com and Veronica Dagher at veronica.dagher@wsj.com

Dow Jones & Company, Inc. All Rights Reserved.

A group of younger workers, devotees of the FIRE movement, are seeking ways to duck mistakes made by prior generations

The Wall Street Journal

Nov 3, 2018

Sylvia Hall, a 38-year-old lawyer in Seattle, plans to retire in two years. PHOTO: Matt Luton for The Wall Street Journal

Sylvia Hall wants to retire at age 40. Her dream has a price: brown bananas.

The 38-year-old Seattle lawyer is on a strict budget as she tries to hit her goal of amassing $2 million in assets by 2020. That means saving about 70% of her after-tax income and setting firm spending limits in every part of her life.

She looks for brown bananas and other soon-to-be discarded items from fruit and vegetable stands to help keep her grocery bills around $75 a month. She walks to work so she doesn’t have to spend money on gas. She borrows Netflix passwords from friends so she doesn’t have to spend much on entertainment.

“

The idea of not having to wait to 65 to start living on my own terms appealed to me,” she said.

For a new generation of Americans, the traditional retirement age of 65 is getting old. Some of the youngest members of the U.S. workforce are saving aggressively and spending little so they can leave work decades ahead of schedule, defying the career arc that typically defines adult life.

Their reasons for flouting conventional career norms and saving at high rates range from dissatisfaction with unfulfilling work to the decline of traditional social safety nets to a desire for more economic security in an era defined by events such as the 2008 financial crisis.

Even though they are better educated than their parents and grandparents, people between 25 and 35 have less wealth than prior recent generations, and “are behind in almost every economic dimension,” said Alicia Munnell, director of the Boston College Center for Retirement Research, including earnings and debt.

Ms. Hall’s apartment is 400 square feet. PHOTO: Matt Lutton for The Wall Street Journal

They’re also watching the generation entering retirement struggle with many of the same problems. About 10,000 people turn 65 every day and many are unprepared for the years ahead. Older Americans have high average debt. Their 401(k)-type retirement funds will bring in a median income of under $8,000 a year for a 65-year-old couple.

The younger generation’s radical solution—dubbed Financial Independence, Retire Early—has spawned an ecosystem of podcasts, blogs, books, conferences and informal discussion groups. One online forum dedicated to the concept, known to its followers by the acronym “FIRE,” has more than 450,000 subscribers.

FIRE adherents are often millennials and younger members of Generation X who have college degrees, above-average incomes and the discipline to adopt a strict do-it-yourself approach to retirement. Some say they are saving as much as three-quarters of their income, or five times the 15% savings rate conventional financial advisers often recommend, and growing their own food. Others are taking more modest measures such as living in smaller houses and driving older cars.

“

It gives people more control over their lives and time,” said Grant Sabatier, 33, who writes a blog about the topic called Millennial Money. “We live in uncertain times and financial empowerment provides a path out.”

The downside of FIRE is its inherent paradox: For those seeking financial security, early retirement can be risky. Since many early retirees rely solely on income from stocks, bonds or real estate for living expenses, sudden market downturns can pose a threat to their plans. At the same time, these people have to forecast their cost of living for decades. This means prolonged periods of high inflation can wreck their forecasts and budgets.

The self-reliance and thrift embodied by FIRE have roots in American history. Elements of the philosophy can be found in Ben Franklin’s 1758 classic “The Way to Wealth,” Ralph Waldo Emerson’s 1841 essay “Self-Reliance” and Henry David Thoreau’s “Walden,” an 1854 book about living simply in a cabin he built near Concord, Mass.

Many FIRE boosters cite a more recent work: the 1992 book “Your Money or Your Life” by Vicki Robin and Joe Dominguez. This paean to financial independence and anti-consumerism, a business best seller in the ‘90s, found a new audience after the 2008 financial crisis.

“

Millennials understand the rules have changed,” said Ms. Robin, now 73. “They understand that the system their parents built is coming apart.”

FIRE enthusiasts gather around the country to discuss ways to save more, spend less, and manage investments. A recent meet-up in Manhattan attracted close to 30 people to an office conference room. The attendees—mostly men in their 20s and 30s, several with backgrounds in engineering—discussed taxes, index funds and real-estate investing over beer and potato chips.

“

We are surrounded by consumerism, advertisements and marketing, and there are a lot of easy ways to spend,” said David Rodriguez, 33, a mechanical engineer who helped organize the meeting. “It is important to have a place to find like-minded people.”

The interest in thrift is flourishing most visibly online where frugality evangelists amass large followings via podcasts, blogs and conferences. One of the most popular FIRE blogs, Mr. Money Mustache, started in 2011, has attracted about 2.5 million page views in the past 30 days, according to Google Analytics data. A podcast devoted to the topic, ChooseFI, has been downloaded 5.2 million times and been played in 190 countries since its inception in early 2017, according to podcast hosting service Liberated Syndication. This puts it in the top 2% of the more than 50,000 podcasts the service hosts.

Ms. Hall visits the library for books and videos; she borrows Netflix logins from friends. PHOTO: Matt Lutton for The Wall Street Journal

Attendees at “FI Chautauqua,” a week-long financial independence conference, spent up to $3,000 this year (not including airfare) to go to Greece and hear leaders in the FIRE community share tips.

Some who have tried the path of early retirement say it isn’t always as idyllic as it sounds. Socializing with people who still have conventional jobs can be awkward, said Ed Ditto, 49, who retired at 36 as an energy trader and now writes the Early Retirement Dude blog. His solution is to invite friends and neighbors to backyard potlucks.

“I don’t bring up the fact that I don’t have a job,” he said. “If someone is interested, I’ll talk about it, but I don’t want to run the risk of stirring up resentment.”

Brandon Ganch, 36, who retired from his job as a software engineer in 2016, said his frugality became an obsession and he stressed over small purchases by his wife. He often got upset when visitors took long hot showers at his former Vermont home or his wife ordered a “$15 main course instead of a $10 sandwich” at a restaurant.

It wasn’t healthy,” said Mr. Ganch, who now lives in Scotland.

“

Frugalwoods” author Elizabeth Thames quit her nonprofit job so she could concentrate on a blog about life as a rural Vermont homesteader, a dream made possible by “extreme frugality” her website says. It says she has found “everything from coats to fondue pots to wine glasses” in the trash and that her husband learned to fix the plumbing.

One complaint from readers was that the 33-year-old author and her husband still earn sizable incomes. Nate Thames works for a nonprofit and was paid about $270,000 in 2016, according to his employer’s most recent tax forms. Ms. Thames makes an undisclosed amount from her blog and a recently published book.

“Now I understand why even with cutting everything to the bone, that we haven’t been able to save like they do,” a reader posted in an online review of the book.

Ms. Thames says she is “transparent about the fact that my husband still works a conventional job from home and that I enjoy working for myself through Frugalwoods.com.”

Mr. Sabatier, 33, says his Millennial Money website made $401,000 last year. Blogger Joe Udo, 44, recently disclosed he has made almost $350,000 since starting “Retire by 40” in 2010.

Tanja Hester, author of a blog called Our Next Life, called for FIRE bloggers to be more transparent about their financial lives in a post this year. She said she makes less than $1,000 a year on the blog, but declines to disclose her income from a book advance, saying “there’s no need to share your actual numbers if you are honest with readers about your general financial situation.”

Emma Pattee, 28, discovered she missed the social benefits of office life. She left a job in marketing two years ago with the goal of writing a novel. She had $150,000 in savings and more than $900,000 in real-estate equity, stemming from a $144,000 home she purchased in Portland, Ore., in 2012 that she says tripled in value, enabling her to purchase four other rental properties. Ms. Pattee, who married in 2015, says she and her husband, Andrew Hanna, 33, live off the rental income and save his salary in medical administration.

“It was hard to go from working every day in an office full of people to sitting in a tiny apartment by myself,” she said. “It is very isolating.”

Recently she began taking on more freelance work as a copywriter. “I got a lot more meaning from my work than I had realized,” she said. “It is a lot harder to find meaning than to save 70% of your income.”

Ms. Hall, the lawyer from Seattle, is hoping to retire with $2 million in assets at age 40. She currently has $1.5 million in assets and expects to hit her goal by 2020. Her plan then is to “Airbnb-it around the world” for 10 months on a retirement income of about $25,000 and visit friends and family the other two months.

She said she is aware of the problems that could trip her up, from unexpected health expenses to a prolonged bear market. But she said she has a detailed plan to secure health insurance abroad and if a market downturn dents her nest egg, she is confident she can adjust her lifestyle.The goal is to try to live in such a way that I won’t be forced to go back to work.”

FIRE proponents say they account for the danger of fluctuating markets by adhering to a rule-of-thumb pioneered by financial planner William Bengen, who concluded retirees should spend no more than 4.5% of their initial nest egg, adjusted annually for inflation, to ensure a high probability of supporting themselves over decades.

It isn’t quite that simple, Mr. Bengen, 71, said in an interview. Younger retirees are more vulnerable to unexpected expenses, and his rule applies only to tax-advantaged 401(k)s and individual retirement accounts for as long as 30 years.

It took a Category 5 catastrophe for Sylvia Hall to start thinking of changing her approach to her finances. When Hurricane Katrina struck the Gulf Coast in 2005, Ms. Hall, then a New Orleans resident, temporarily lost a home and a paycheck as the first payments were due on $101,600 in law-school debt.

The uncertainty was so unsettling Ms. Hall instituted a strict budget. She started buying discounted meat on its expiration date, took a second job delivering pizzas and began saving half of her $50,000 salary after her law firm reopened in 2006.

After setting aside about $250 a month for discretionary expenses, Ms. Hall devoted the rest—over $2,000 a month—to student loans. By 2009, she had paid off all but $35,000, which she consolidated at 1.6%.

“Not having anything freed me up to not be beholden to stuff and status and to be comfortable and happy with less,” Ms. Hall said. “There’s something liberating about that.”

Ms. Hall plans to have $2 million in assets when she retires. PHOTO: Matt Lutton for The Wall Street Journal

She stumbled on the Mr. Money Mustache blog in 2012, after moving to Seattle. The idea of retiring early resonated. She increased her savings to about 70% of her after-tax proceeds, which are now about $100,000, and limited her spending to no more than $30,000 annually. That includes $2,400 a year on car and homeowners’ insurance, $10,200 on mortgage payments and $75 a month on groceries.

Her grocery budget is so detailed she knows how much she will pay each month for oatmeal (a five-pound bag costs her $3), blueberries (a five-pound bag costs $10), popcorn (1 pound for $2) and rice (60 cents per pound). Now a vegan, she buys fruit at a stand that sells “a table of things that didn’t sell” at steep discounts, including brown bananas she freezes and uses for smoothies.

An occasional splurge is a $5 bottle of wine, or a box for $15.

Ms. Hall, who is single, frequently has friends over for potluck dinners, travels using rewards points on her credit cards, and buys season tickets to the theater for a price that works out to about $15 a month.

“I have always lived on very little but never felt I was being deprived,” she said. “If I made twice the money, I don’t think anything would change. There is nothing I want that I don’t have.”

Write to Anne Tergesen at anne.tergesen@wsj.com and Veronica Dagher at veronica.dagher@wsj.com

Dow Jones & Company, Inc. All Rights Reserved.

oh wait I googled! I thought the limits were lower...we might be fine, says 62k for couples. We'll really need to strategize, maybe not collect the pension for a while and live off his deferred comp if we need more income than my pay. Makes planning hard because you just don't know what the situation will be till you get there. We just keep saving the most we can.

oh wait I googled! I thought the limits were lower...we might be fine, says 62k for couples. We'll really need to strategize, maybe not collect the pension for a while and live off his deferred comp if we need more income than my pay. Makes planning hard because you just don't know what the situation will be till you get there. We just keep saving the most we can.

Comment