I am not associated with the website linked, I just found this article and several others on the site very eye opening.

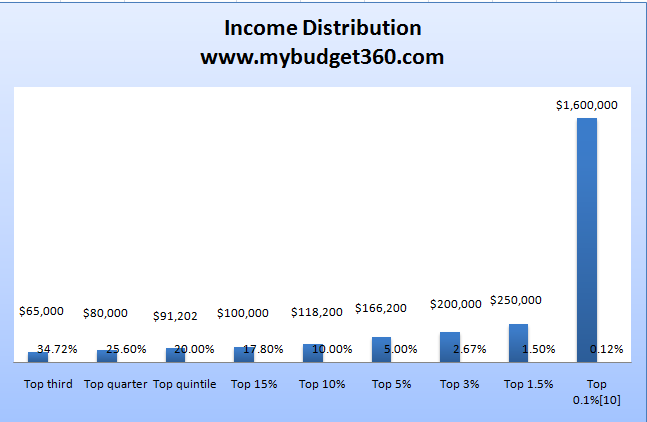

"The fact that only 34% make more than $65,000 is astounding given how expensive other cost of living items have gotten over the past decade. That is why the middle class is feeling squeezed from all different sides."

Here are some shocking graphs representing food stamp growth over the pay decade and it is astounding as well. I hear the numbers on the news and it sounds like alot, I guess I am just a visual person as the graphs really seem to sink in with me.

Comment