Saw this on bogleheads. FIDO also cut the ER's on most of their current index funds by 35%. Great news for me as I am all in on FIDO index funds.

Logging in...

Fidelity offering 0% Expense Ratio (ER) funds

Collapse

X

-

From Fidelity's website:

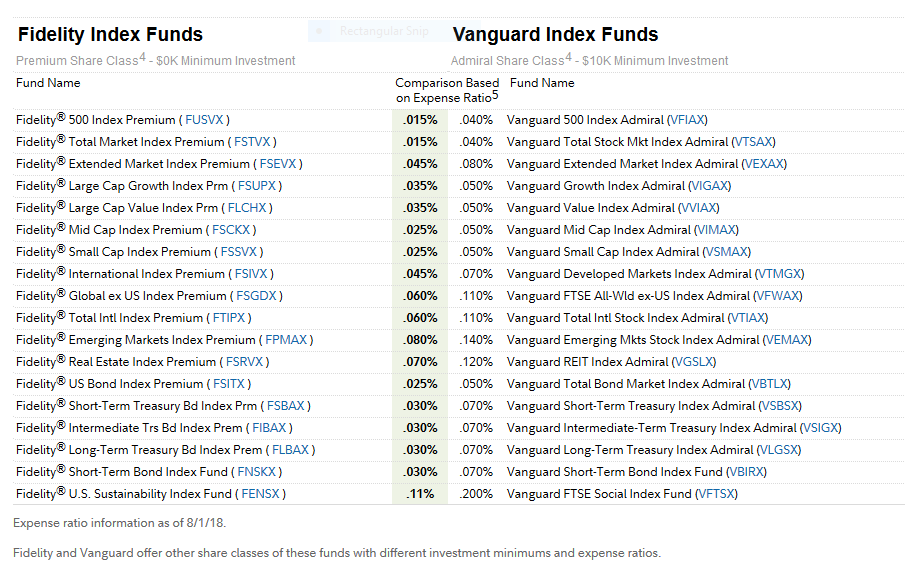

And here is their comparison with Vanguard.Proving what it means to put value first

At Fidelity, we're committed to giving you value you can't find anywhere else. That's why we're introducing zero expense ratio index mutual funds.1 Layer on no minimums to invest in Fidelity mutual funds,2 no minimums to open an account, and no account fees3 – now that's value.

What I don't get about this is - how is Fidelity making money from these accounts? Payment for order flow?james.c.hendrickson@gmail.com

202.468.6043

-

-

Wait, do you mean Fidelity allows short selling?Originally posted by corn18 View PostThey lend out the shares.james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

So will the other company's eventually cave and offer the same? My guess is yes in order to be competitive.Last edited by creditcardfree; 08-01-2018, 01:44 PM.My other blog is Your Organized Friend.

Comment

-

-

I also believe that the others will, yes, especially from ones that offer full financial services. The basic gist that I understood it is that stuff like this is a loss leader to reel in new customers, and make up for it with the other services that they provide, especially over the long term.Originally posted by creditcardfree View PostSo will the other company's eventually cave and offer the same? My guess is yes in order to be competitive.

Comment

-

-

One analysis of Vanguard's Response:

Source: Dan Wiener and Jeff DeMasoYesterday Vanguard competitor Fidelity Investments took indexing to a new low—a low in prices, that is. The firm is offering total U.S. stock and total foreign stock index funds with zero operating expenses and zero fees. That's about as low as you can go without giving investors rebates.

Vanguard, not surprisingly, was silent on the issue other than to say it was continuing its commitment to lowering prices for its own funds. Dan and I think Vanguard missed a wonderful marketing opportunity around the Fidelity announcement—and that they should have borrowed a page from Apple Computer, which in 1981 hailed the introduction of IBM's first personal computer with full-page ads in major newspapers welcoming IBM to the business. And if you read that ad, and think about how Vanguard could have done the same thing by promoting its long history of fee-cutting and pioneering the index fund, you'll see how Vanguard could have turned the story around. But the marketers at Vanguard apparently aren't old enough to remember how classy that Apple ad was. Too bad—they missed a huge opportunity.james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

This sounds great on the surface but in my experience...there is no free lunch.

Fidelity has shareholders. Those shareholders expect to make money. Im guessing this is a way to get people in the door...then sell them other crap they may not need.

Vanguard is owned by its funds. Funds are owned by anyone who invests. Vanguard has no other outside investors. Even with fees...vanguard is still superior, imo.

Comment

-

-

Fidelity is privately held.Originally posted by rennigade View PostThis sounds great on the surface but in my experience...there is no free lunch.

Fidelity has shareholders. Those shareholders expect to make money. Im guessing this is a way to get people in the door...then sell them other crap they may not need.

Vanguard is owned by its funds. Funds are owned by anyone who invests. Vanguard has no other outside investors. Even with fees...vanguard is still superior, imo.

Comment

-

-

If available I may use these Fidelity funds in a future Roth or 401k contribution. I especially like that there appears to not be a minimum fee to purchase a mutual fund. I recently was looking to add an international aspect to some of my accounts - I'm not comfortable using ETFs and the pricepoint was going to be $3K for the initial mutual fund purchase - now I can transition in as I please.

I'm probably going to continue to keep my brokerage accounts associated with Vanguard. I may be overstating the benefits, but the impression I'm under is that Vanguard's index funds have outperformed Fidelity's funds when it comes to minimizing taxable events/capital gains. The relevance of that likely varies person to person and most people won't be using brokerage regardless.

Comment

-

Comment