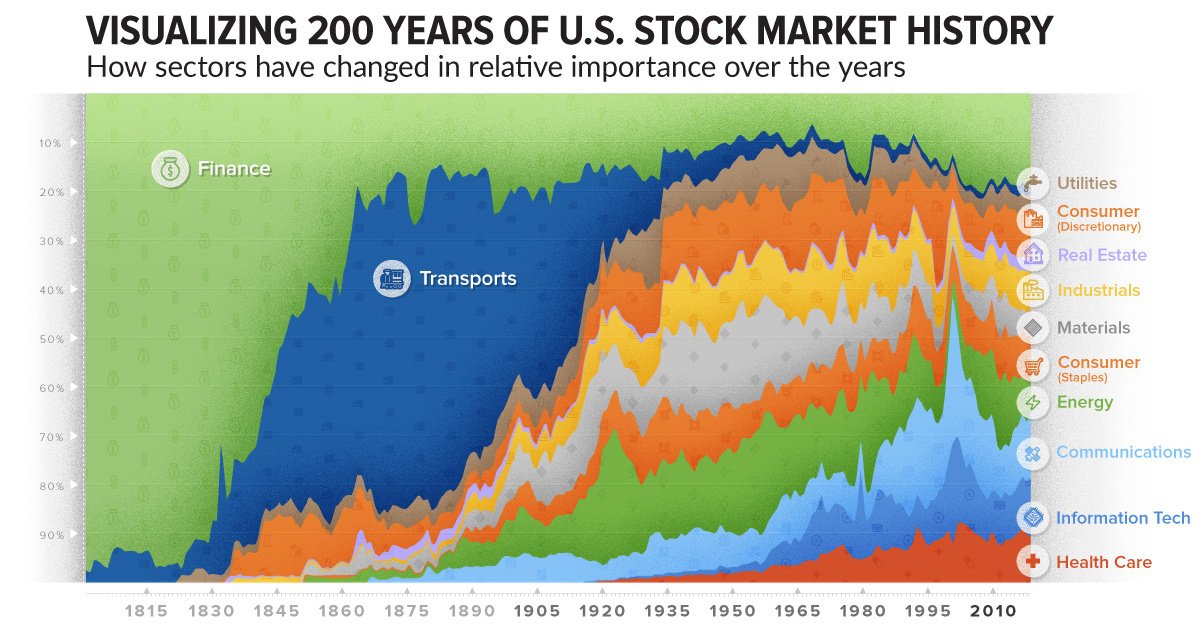

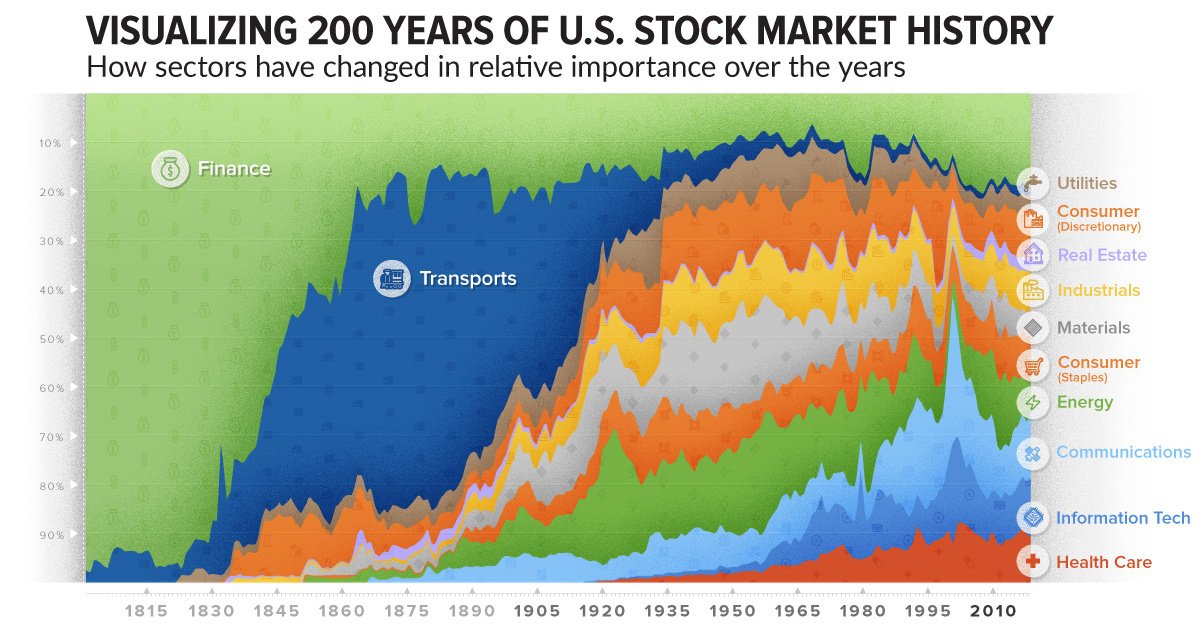

Here is a fun chart from PBS. Its 200 years of stock market history.

In 1850 I would be hard to convince anyone that railroad stocks weren't the way to go. Back then governments were offering subsidies and grants to stimulate growth. During the 1860s - 1870s some huge amount of new track was laid, something like 33,000 new miles of track. But, investors who held only railroad stocks would have missed out on later opportunities.

So, while some of the historical trends in the chart are obvious it does illustrate the unpredictability of markets in general.

In 1850 I would be hard to convince anyone that railroad stocks weren't the way to go. Back then governments were offering subsidies and grants to stimulate growth. During the 1860s - 1870s some huge amount of new track was laid, something like 33,000 new miles of track. But, investors who held only railroad stocks would have missed out on later opportunities.

So, while some of the historical trends in the chart are obvious it does illustrate the unpredictability of markets in general.

Comment