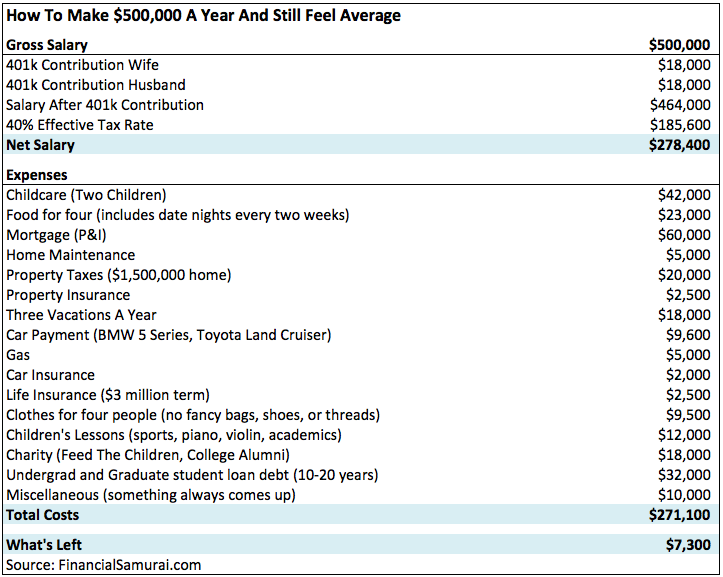

Using some reverse math, that mortgage looks to be a 1 million borrowed which is 2x earnings but the cost of the house being 1.5 million is 3x earnings. They had 500k down but didn't use that money on their student loans or pay cash for a car? Jesus...

Childcare looks to be private school considering they are old enough to spend 18k/year on extra curricular activities.

Those are some serious gas cost.

Comment