Who has all the money?

For those who'd rather not click a hyperlink...go to break.com and search, who has all the money.

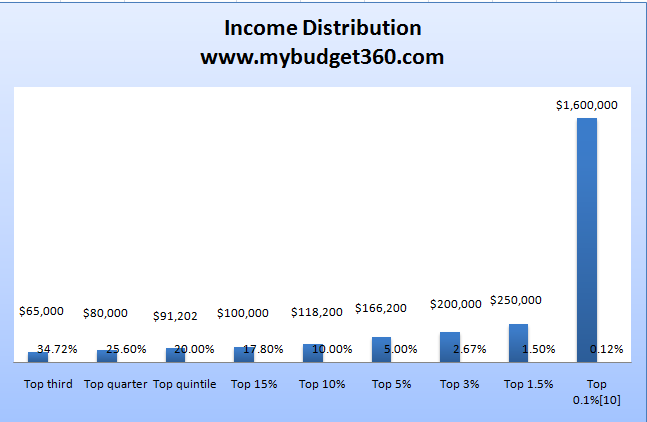

I certainly didn't realize the distribution of wealth was this crazy.

A little snip from it...The 1%ers control 40% of the nations wealth...the 80% of the other people control 7% of the nations wealth between all of them!

Its crazy to think that if you added up everyones wealth below the "rich" people, 80% of the nation...is almost 6 times lower than the 1%ers.

Pretty mind bending considering most if not all people on this forum are the 80%...we're hardly a blip on the radar.

For those who'd rather not click a hyperlink...go to break.com and search, who has all the money.

I certainly didn't realize the distribution of wealth was this crazy.

A little snip from it...The 1%ers control 40% of the nations wealth...the 80% of the other people control 7% of the nations wealth between all of them!

Its crazy to think that if you added up everyones wealth below the "rich" people, 80% of the nation...is almost 6 times lower than the 1%ers.

Pretty mind bending considering most if not all people on this forum are the 80%...we're hardly a blip on the radar.

Comment