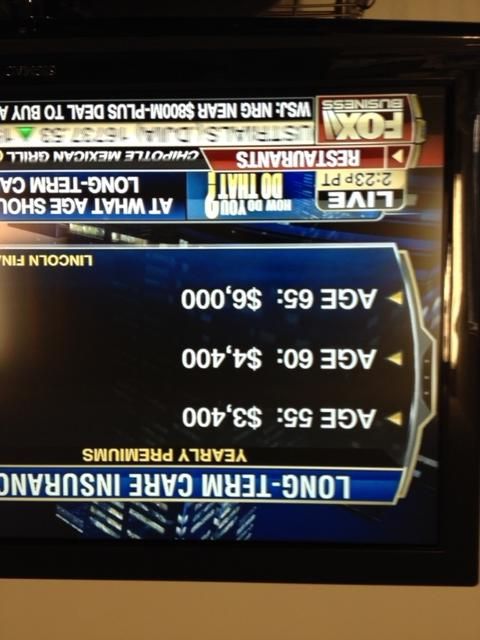

According to long term care specialists, it is best to buy ltc insurance while you're in your 50's. This is the ideal age to buy because of lower premiums and because your ages makes you qualified for coverage. When you purchase coverage early, you'll only have 2-4% increase in premiums unlike when you're in your 60's, it can go as high as 6-8%. When it comes to choosing the policy, I suggest you should assess your needs first in order to find the most fitting coverage for you.

Logging in...

Long Term Care Insurance

Collapse

X

-

I bought a policy 5 years ago thru my work benefits thru John Hancock. I am pre-paying it in 10 years. After 10 years I will be done paying the premiums. It covers 3 years of full time nursing home care or in-home care (which is cheaper and would give me more years), it has 5% inflation rider and I have a forfeeture clause. So far my premiums have stayed the same but I understand they could petition the state insurance commission to raise rates. With the forfeiture clause if I had to cancel(due to not affording the premiums) all the money I paid in would not be lost and available for use should I need it. We also get all the money we paid in if we die before 70 without using it.

I only have this policy on my husband as altzheimers runs in his family. He was 45 when we first got it and we'll be done paying when he is 55. I hope at that time the rates are still affordable to get a policy on me, I'll be 52 at that time. I couldn't afford to get the policy on both of us as I pay $358/mo for his policy. My policy is more expensive because of the 5% inflation rider and the non forfeiture clause. All told the policy premiums for 3 years (w/o any rate hikes) of nursing home care will run $42,960. Right now in my area nursing homes are around 70k for a year.

I liked the idea of prepaying a policy because of all the horror stories I read of seniors not being able to afford the rate hikes later in life and having to drop their policies. Plus when I was looking I could not find any policies that would have the same premium for the life of the policy. Is anyone finding these types of policies now? I'd be interested if so.

I also should add, should I lose my job I would still get the group rate and able to make the payments outside of my work paycheck.

Comment

-

-

Purchased policy early

Hello,

I purchased a LT policy over 10 years ago for my wife and I. I was 33 at the time and my yearly rate is $1,265 for the both of us. The rates have never increased. We get a $165/day benefit which is paid directly to us (no receipts or bills need to be presented). We also have a 5% inflation increase rider. I purchased this plan when I did because it was just too good to pass up.

Even if my wife and I lose our jobs we can still afford to pay the premium and this gives us piece of mind.

We've made some bad mistakes financially in the past, but this one was not one of them.

LionelLast edited by jeffrey; 02-01-2014, 10:32 PM.

Comment

-

-

Long term care insurance does not necessarily have a magic number in terms of age, the question should be how risk averse you are or are you even insurable, even if you are as young as 50 years old, you might have some health issues that would make you not qualified for getting one. Long term care cost is based on your age so it would be wise to get it while you are still young, healthy and financially able. Policies and cost of premiums varies widely depending on the insurance company and the state where you are located. Long term care insurance is just like any other product, one size does not fits all, so basically there are many factors to consider.Originally posted by moneybags View PostDo any of you have Long Term Care Insurance? What age should I be getting this? Any advice on policies, etc.?

The product has evolved since so now you have the option to buy combination product like life and long term care insurance. It would be wise to talk to a licensed experienced agent, you may also opt to get free long term care insurance quotes online so you can compare and choose the best one. Long term care insurance can protect you from things that might cause financial devastation. I have listed a few resources where you can get comprehensive information about long term care and long term care insurance:

longtermcare.govLast edited by jeffrey; 03-17-2014, 05:21 AM.

Comment

-

-

I hope this information can help anyone who is looking for relevant informaiton on long term care insurance. The current rates can pretty much give you an idea the best time to buy coverage. Here is the price index for 2016 according to American Association for Long-Term Care Insurance.Originally posted by moneybags View PostDo any of you have Long Term Care Insurance? What age should I be getting this? Any advice on policies, etc.?

Single Male Age 55 -$960 - $2,035 annually

Single Female Age 55 - $960 - $2,580 annually

Couple Both Age 60 - $1,920 - $3,560 annually

Types of LTCI

1. Reimbursement long term care insurance – policyholder will pay for the total amount of care first and then the policy will reimburse the exact amount paid.

2. Indemnity long term care insurance – this is more expensive than reimbursement because it provides the policyholder’s daily benefit amount regardless of the bill.

3. Partnership long term care insurance – this type of policy allows the policyholders to receive Medicaid benefits without downsizing their assets after exhausting their policy benefits.

Comment

-

Comment