Hello all!

I just found this site and am very interested.

I have a question about setting up a 'procedure' for putting money away in savings. My wife and I have finally gotten to the point where we can pay our bills with no overtime at either job. It's tight, but it's possible. We've cut back on a bunch of stuff (basic cable! and I install home theaters!!) but have NO savings other than 401K.

I am not at all comfortable with this. Things always come up, as you all know. We both know this as well. However, it's taken us a long time to get to the point where we can survive without having to worry. We're ready to get to the next step.

I want to save for the following things...

Emergency Fund

Long-term (retirement) savings

College Fund (13 year old step-daughter & continuing education for the wife)

Vacation fund (we have a 7 day trip coming up in 2 months with nothing put away...)

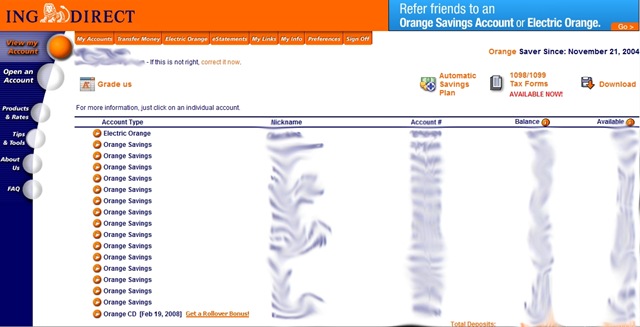

How do I go about doing this? I'm currently putting 5% of my pay towards my 401k and my employer is matching up to 3%. I'm thinking of having $100 per pay direct deposited into an INGdirect account. I think that's a good start, but how do I allocate money to all of the above things I want to save for? And how much should I save for each thing? If I just sock money away, it will end up going towards something it was not meant for.

I'd love some real-world examples of how people are handling this. I can think of a ton of ways to do this, but I'd like to hear what has proven to work for people.

Thanks!

Jim

I just found this site and am very interested.

I have a question about setting up a 'procedure' for putting money away in savings. My wife and I have finally gotten to the point where we can pay our bills with no overtime at either job. It's tight, but it's possible. We've cut back on a bunch of stuff (basic cable! and I install home theaters!!) but have NO savings other than 401K.

I am not at all comfortable with this. Things always come up, as you all know. We both know this as well. However, it's taken us a long time to get to the point where we can survive without having to worry. We're ready to get to the next step.

I want to save for the following things...

Emergency Fund

Long-term (retirement) savings

College Fund (13 year old step-daughter & continuing education for the wife)

Vacation fund (we have a 7 day trip coming up in 2 months with nothing put away...)

How do I go about doing this? I'm currently putting 5% of my pay towards my 401k and my employer is matching up to 3%. I'm thinking of having $100 per pay direct deposited into an INGdirect account. I think that's a good start, but how do I allocate money to all of the above things I want to save for? And how much should I save for each thing? If I just sock money away, it will end up going towards something it was not meant for.

I'd love some real-world examples of how people are handling this. I can think of a ton of ways to do this, but I'd like to hear what has proven to work for people.

Thanks!

Jim

Comment