Originally posted by Jluke

View Post

Logging in...

When to buy in on VTSAX?

Collapse

X

-

Guessing all the major brokers allow fractional shares nowadays. I mainly use ameritrade and fidelity and both have it. Note that if you want stock, eft, and mutual fund dividends to reinvest fractionally, you will have to turn that option on. Some people don't like it, but I prefer to reinvest all dividends. Of course dividends tend to be between 1-3% for most funds and stocks, but it still is a nice way to periodically DCA without actually adding money in manually.

-

-

Unfortunately Vanguard doesn't allow fractional ETF purchases yet. I'm hoping that they open this up at some point... I'd really love the option to just purchase round-number dollars into my ETFs, rather than only buying in 1-x whole-share amounts.Originally posted by ~bs View Post

Guessing all the major brokers allow fractional shares nowadays. I mainly use ameritrade and fidelity and both have it.

Comment

-

-

I do lean for ETF's here. But for the OP, it sounds like the mutual fund may be better... As most companies allow you to "auto invest" in mutual funds , where ETF you have to remember to log on to your client site and make ETF purchase X times per Y, for you to make you routine purchases. I'm a pretty diligent DIY investor, and I still miss some of my routine purchases on my ETF"s. (too many accounts... I need to consolidate )Originally posted by Singuy View PostETF is best as it doesn't generate taxable events if this is added to a taxable account compared to index funds. Own any of it's in nontaxable account, only go for ETF in taxable account.

Merely saying, in interest of simplicity and routine. Mite be a good way to Auto-invest yourself into a good habit. (you can always re balance later)

Comment

-

-

Yep, no auto-invest with ETFs unfortunately, probably because you have to buy whole shares. You can't just send in $100/month or whatever.Originally posted by amarowsky View Post

I do lean for ETF's here. But for the OP, it sounds like the mutual fund may be better... As most companies allow you to "auto invest" in mutual funds , where ETF you have to remember to log on to your client site and make ETF purchase X times per Y, for you to make you routine purchases.

I do buy an ETF monthly but it's just part of my monthly financial routine so I don't mind it.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

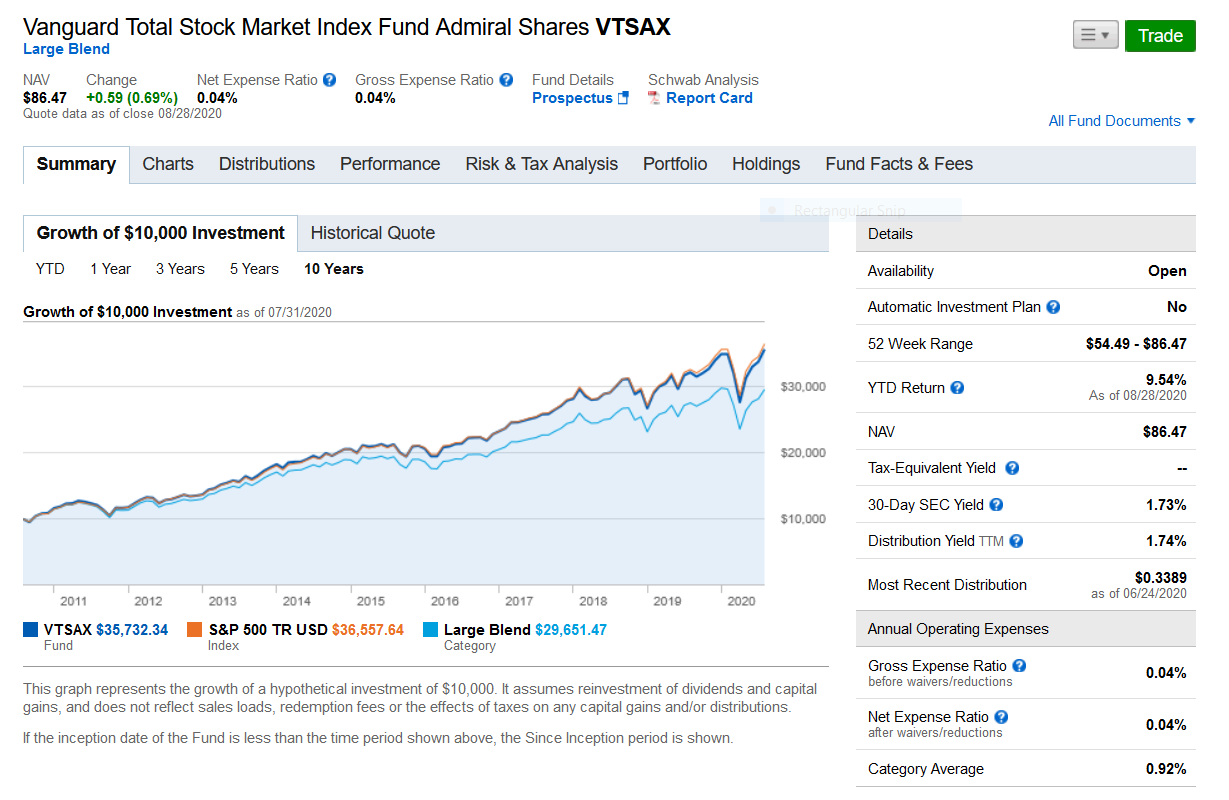

For those on the board, viewers and assorted lurkers, here is an overview of VTSAX, from Schwab.

james.c.hendrickson@gmail.com

james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

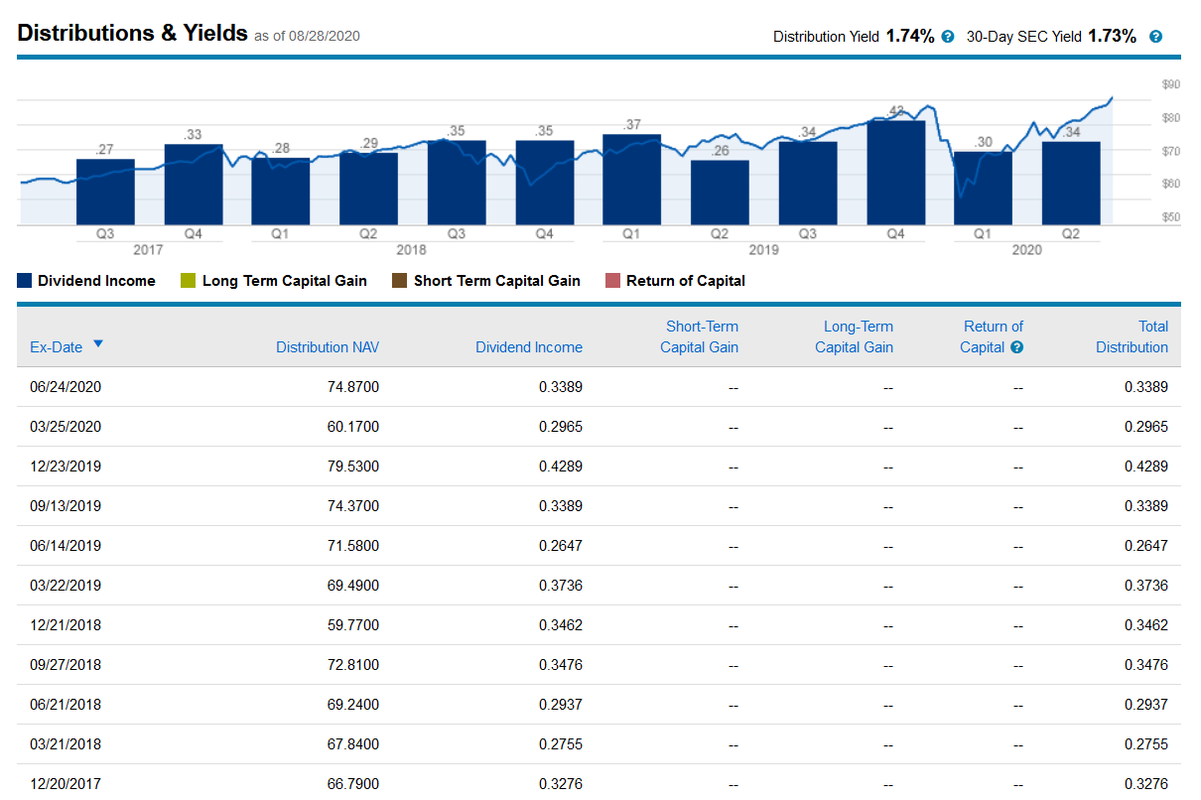

Per schwab, here are the last couple of years of distribution payments.

VTSAX is good in terms of its dividend payments, but its not great. You'd be getting 1.74% which is about keeping up with inflation these days.

james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

True, but also irrelevant since it's a growth fund, not an income vehicle.Originally posted by james.hendrickson View PostVTSAX is good in terms of its dividend payments, but its not great. You'd be getting 1.74% which is about keeping up with inflation these days.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

Yeah, it is a good option for the small investor. Also good for investors that would rather just keep their money fully allocated rather than getting dividends, and having to reinvest it periodically. TDameritrade below. Stocks, efts, mutual funds.Originally posted by kork13 View PostUnfortunately Vanguard doesn't allow fractional ETF purchases yet. I'm hoping that they open this up at some point... I'd really love the option to just purchase round-number dollars into my ETFs, rather than only buying in 1-x whole-share amounts.

------------------------------ Convenient Way to Grow Your Positions

The dividend reinvestment plan (DRIP) automatically reinvests stock & ETF dividends, as well as mutual fund cash distributions by purchasing additional whole or fractional shares.

You can receive fractional or partial shares in DRIP if your reinvestment doesn't equal a whole number. Learn more about selling fractional shares.

Stock & ETF Dividends- Eligible securities: More than 5,000 U.S. listed and Nasdaq stocks, and most American Depository Receipts (ADRs)

- Timing: One to three business days to complete most dividend reinvestments; possibly longer if the company paid a large distribution or required special processing

- Fractional shares display: Fractional share amounts are not displayed on the order status page; to view them, go to My Account > Positions or History & Statements > Statements

By enrolling in DRIP, you agree to the DRIP terms and conditions

Mutual Fund Distributions

Mutual fund distributions have two components: capital gains and dividends. You can choose to reinvest the total distribution, or just the capital gain or dividend component.- Eligible securities: All mutual funds

- Fractional shares display: To see your fractional shares, go to My Account > Positions or History & Statements > Statements

By enrolling in DRIP, you agree to the DRIP terms and conditions

Comment

Comment