Originally posted by maryadavies

View Post

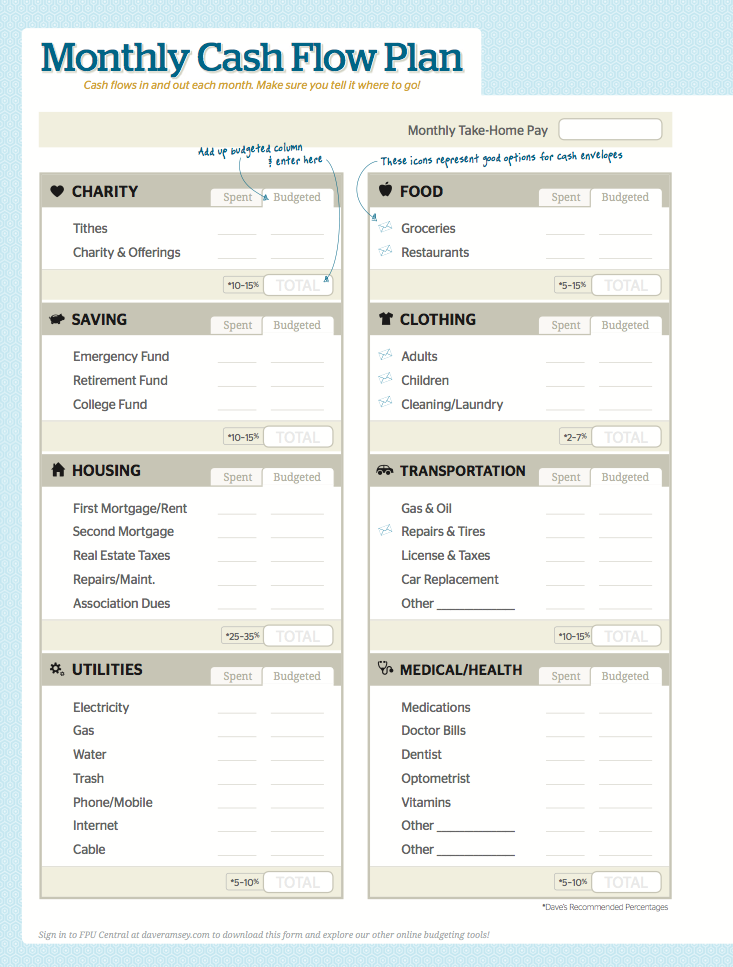

You can find a lot of what Dave Ramsey teaches online for free for example here's the PDFs for a budget: https://www.daveramsey.com/budgeting/how-to-budget/

The Quick Start Budget and Monthly Cash Flow Plan have really helped us.

How to Budget Using Simple, Zero-Based Budgeting

Don’t expect your budget to run smoothly the first month or two. It usually takes a few months to get a good feel on where all your money is going. Give it a little time, and be patient!

1. Write down your total income.

This is your total take-home (after tax) pay for both you and, if you’re married, your spouse. Don’t forget to include everything—full-time jobs, second jobs, freelance pay, Social Security checks, royalties from your chihuahua’s acting gig, and any other ongoing source of income."

2. List all your expenses.

Think about your regular bills (mortgage, electricity, etc.) and your irregular bills (quarterly payments like insurance or HOA) that are due for the upcoming month. After that, total your other costs, like food, gas, food, entertainment, food, and anything else that comes to mind (like food). Every dollar you spend should be accounted for."

3. Subtract expenses from income to equal zero.

This is called a zero-based budget, meaning your income minus your expenses should equal zero. If you’re over or under, check your math or simply return to the previous step and try again."

Don’t expect your budget to run smoothly the first month or two. It usually takes a few months to get a good feel on where all your money is going. Give it a little time, and be patient!

1. Write down your total income.

This is your total take-home (after tax) pay for both you and, if you’re married, your spouse. Don’t forget to include everything—full-time jobs, second jobs, freelance pay, Social Security checks, royalties from your chihuahua’s acting gig, and any other ongoing source of income."

2. List all your expenses.

Think about your regular bills (mortgage, electricity, etc.) and your irregular bills (quarterly payments like insurance or HOA) that are due for the upcoming month. After that, total your other costs, like food, gas, food, entertainment, food, and anything else that comes to mind (like food). Every dollar you spend should be accounted for."

3. Subtract expenses from income to equal zero.

This is called a zero-based budget, meaning your income minus your expenses should equal zero. If you’re over or under, check your math or simply return to the previous step and try again."

so that's going to mess things up for a while.

so that's going to mess things up for a while.

Comment