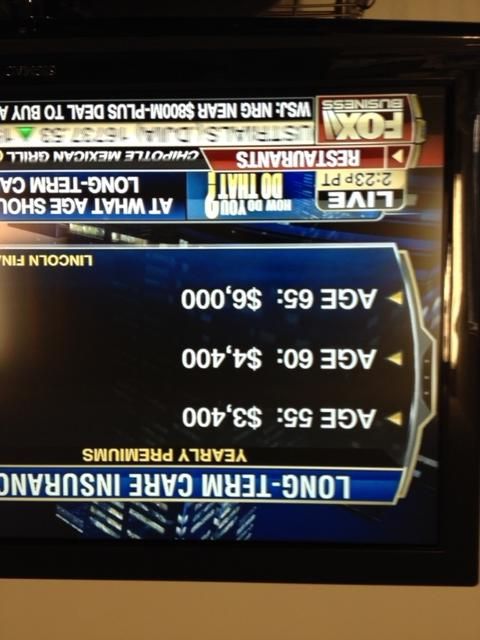

My husband and I are approaching 60 and it's time to buy long term care insurance. We've looked at two options and were given these prices:

Option 1. $4700 per year ordinary "term" style. If you don't need it, it's gone. This is a discounted group rate offered by our Credit Union.

Option 2. A one time premium of $100,000 and you are covered for life. If you never use it, the money (plus interest) goes to your estate.

We have about $1 million in retirement accounts but we are $90,000 in debt with our "on budget" accounts (credit cards and home equity line). So we don't have cash around for option 2. But buying option 1 right now would be a strain also because of our tight monthly budget.

Normally we wouldn't cash in our retirement accounts for anything, however, long term care might be the exception. It's what we've been saving it for all our lives (to take care of us in old age). If we convert $100,000 of our retirement investments to that LTC policy, this protects the remaining $900,000 for the other spouse to live comfortably. And if neither of us needs it, the kids will get the premium back when we die.

On the other hand, option 1 will protect the entire $1 million - initially. It is likely one or both of us will live at least 20 more years. Option 1 will end up costing more than $100,000 over that time and who knows how much they will raise the premiums. If we never need it, it will be money thrown away, plus we will need to pay the yearly premiums after we retire and are living on a much reduced monthly budget.

For that reason I am leaning to option 2. But I want to gather opinions and any experience or knowledge any of you want to share. Thanks in advance.

Option 1. $4700 per year ordinary "term" style. If you don't need it, it's gone. This is a discounted group rate offered by our Credit Union.

Option 2. A one time premium of $100,000 and you are covered for life. If you never use it, the money (plus interest) goes to your estate.

We have about $1 million in retirement accounts but we are $90,000 in debt with our "on budget" accounts (credit cards and home equity line). So we don't have cash around for option 2. But buying option 1 right now would be a strain also because of our tight monthly budget.

Normally we wouldn't cash in our retirement accounts for anything, however, long term care might be the exception. It's what we've been saving it for all our lives (to take care of us in old age). If we convert $100,000 of our retirement investments to that LTC policy, this protects the remaining $900,000 for the other spouse to live comfortably. And if neither of us needs it, the kids will get the premium back when we die.

On the other hand, option 1 will protect the entire $1 million - initially. It is likely one or both of us will live at least 20 more years. Option 1 will end up costing more than $100,000 over that time and who knows how much they will raise the premiums. If we never need it, it will be money thrown away, plus we will need to pay the yearly premiums after we retire and are living on a much reduced monthly budget.

For that reason I am leaning to option 2. But I want to gather opinions and any experience or knowledge any of you want to share. Thanks in advance.

Comment